Best Crypto Staking Platforms

Key Takeaway: Crypto staking lets holders earn passive income by locking assets to validate networks. Leading platforms like Uphold, Binance, Kraken, and Lido simplify the process with intuitive dashboards, competitive yields, and institutional grade security for retail investors.

- Staking rewards fluctuate with token supply, validator uptime, and inflation dynamics.

- Longer stake periods may raise rewards but restrict liquidity during volatility.

- Always review platform fees, audit reports, and legal standing before delegating assets.

- Diversifying stakes across networks can balance yield, risk, and upgrade uncertainty.

Choosing the wrong staking platform can drain yields through hidden fees. Poor security may expose wallet keys and result in irreversible losses. Unreliable validators can miss blocks and slash your staked balance. Some unregulated enterprises disappear overnight, leaving investors with frozen funds. I once reviewed a service promising huge returns yet never paying. Such events stress the need for verified reserves and transparent governance. This guide compares only licensed platforms with audited smart contracts. Read on to discover reliable options and safeguard your staking journey.

Why You Can Trust CoinBlockLab

At CoinBlockLab, we don’t just skim the surface—we dig deep. Every recommendation you see is backed by hands-on testing, rigorous research, and a commitment to transparency. Our editorial team operates independently, meaning advertisers have zero influence over our ratings or reviews. We believe crypto should feel less like a gamble and more like a guided journey—and that starts with trustworthy information.

- 32+ Crypto Platforms & Wallets Personally Tested

- 187+ In-Depth Crypto Guides & Tutorials Published

- 61 Years Combined Editorial Experience

- 6120+ Research Hours Logged

- 22+ Expert Contributors

- Every Fact Verified by Human Editors

- 100% Human-Written Reviews

We’re here to help you navigate the crypto world with confidence, not confusion. You deserve clarity, not hype—and that’s exactly what we deliver.

6 Best Crypto Staking Platforms at a Glance

Here are 6 leading crypto staking platforms I recommend you try:

- Uphold: Simple staking access with transparent yields and regulated US backing.

- Pionex: Automated exchange delivering bot driven staking and adaptive yield optimization.

- Zengo: Keyless wallet staking featuring strong MPC security and biometric recovery.

- Binance: Market leading exchange offering flexible staking terms and competitive reward rates.

- Kraken: Veteran platform with audited proof of reserves and straightforward staking interface.

- Lido: Decentralized liquid staking protocol enabling easy Ethereum participation without lockups.

Best Crypto Platforms for Staking Rewards (Reviewed)

| Platform | Form Factor & Build | Connectivity | Supported Assets / Features | Our Rating |

| Uphold | Cloud-based multi-asset exchange; web & mobile apps; simple UI for quick swaps | Online only (web, iOS, Android); bank transfer, cards, crypto deposits | 250+ cryptos, 27 fiat, precious metals, cross-asset trading | 4.4/5 |

| Pionex | Centralized exchange with built-in trading bots; web & mobile | Online spot & futures; 16 free bots; API; crypto deposits | 250+ cryptos, grid/DCA/AI bots, leverage futures bots | 4.1/5 |

| Zengo | Mobile-only wallet; MPC key-less recovery; sleek UI | Online via WalletConnect, in-app swaps; Apple Pay, cards, bank transfer | 100+ cryptos, NFTs, Web3 dApp access; DeFi connectivity | 4/5 |

| Binance | Centralized exchange; desktop, web & mobile apps; extensive toolset | Online spot, margin, futures, staking; API; P2P; cards, ACH | 350+ cryptos, 1,000+ pairs, staking, NFTs, loans | 3.8/5 |

| Kraken | Centralized exchange; web & mobile; pro interface & OTC desk | Online spot, futures, staking; bank wires, cards, ACH | 220+ cryptos, futures up to 50×, staking yields, NFT marketplace | 3.5/5 |

| Lido | Decentralized liquid-staking protocol; web dashboard & dApp integrations | On-chain via smart contracts; WalletConnect; supports multiple networks | ETH, SOL, MATIC, DOT, more via stTokens; 100+ DeFi integrations | 3.5/5 |

1) Uphold

Expert Insights: Why Consider Uphold?

Uphold appeals to new stakers who want straightforward access to high-yield rewards without sacrificing transparency. The exchange publishes real-time proof-of-reserves and never lends customer assets, making it a perfectly balanced entry point backed by rigorous compliance.

Founded in 2014, Uphold has evolved into a multi-asset platform spanning crypto, fiat, and precious metals. The company discloses its reserve ratio every few minutes and holds 100% of client deposits in segregated wallets, underscoring a security-first philosophy. Independent audits, strong regulatory oversight by FinCEN, and advanced encryption add further trust layers.

Reputation-wise, industry reviewers highlight its intuitive interface and broad staking menu, while verified users praise smooth fiat on-ramps. I appreciate how the $1 minimum lowers the barrier for casual investors. Beginners, passive yield seekers, and asset-to-asset swap enthusiasts will feel right at home.

Uphold Standout Features

- Multi-asset Support: Stake various cryptocurrencies and stablecoins in one place.

- Regulatory Compliance: Operates in regulated markets with clear operational rules.

- Instant Conversion: Convert between crypto and fiat seamlessly and securely.

- Transparent Fees: Fee structure clearly stated before staking transactions.

- User Dashboard: Visual dashboard showing staking earnings and balances in real time.

- Mobile App: Stake on the go with a clean, mobile-friendly interface.

- Auto Compound: Automatically reinvest staking rewards to boost yield potential.

Uphold Pros

- Uphold publishes reserves every 30 seconds for full transparency.

- Trading between any two assets feels seamless.

- I like the low $1 minimum trade size.

- Rewards reach 17.6% on select staking coins.

Uphold Cons

- Spread fees run higher during low-liquidity periods.

Visit: https://uphold.com/

2) Pionex

Expert Insights: Why Consider Pionex?

Pionex brings automated crypto staking within easy reach of anyone. The exchange blends low trading fees with built-in bots that compound rewards smoothly for hands-off investors.

Launched in 2019, Pionex operates a licensed crypto exchange that routes liquidity through Binance and Huobi for deep order books. Independent audits verify reserves, while U.S. FinCEN registration underlines a strict compliance culture. Its custodial wallets employ multi-sig cold storage to protect client assets against breaches. I appreciate how the platform demystifies staking by auto-allocating coins into vetted pools.

Beginners who want reliable, set-and-forget earnings, and experienced traders seeking passive yield alongside spot activity, both find it appealing. We see strong adoption across Asia and an expanding European footprint, reflecting a reputation for stable infrastructure and timely payouts.

Pionex Standout Features

- Auto-staking Bot: Reinvests daily yield without manual steps.

- Grid Trading Bot: Earns spreads while staked funds keep accruing.

- Smart Rebalancer: Maintains target allocations across multiple staked coins.

- Dual-investment Plans: Boost APR by selling covered options seamlessly.

- 0.05% Maker Fee: Industry-low costs preserve staking returns.

- 120+ Staking Assets: Broad choice from majors to DeFi newcomers.

- API Access: Automate strategies or export earnings to tax tools.

- 24/7 Live Chat: Multilingual support resolves payout queries quickly.

Pionex Pros

- Investors enjoy hands-free staking and compounding.

- Fees tay low, improving net annual returns.

- I like the transparent proof-of-reserve dashboard.

Pionex Cons

- Interface can overwhelm absolute beginners initially.

- I find limited fiat ramps constrain quick cashouts.

Visit: https://www.pionex.com/en/

3) Zengo Crypto Wallet

Expert Insights: Why Consider Zengo?

Zengo offers a fresh, user-friendly entry into crypto staking thanks to its intuitive design and seamless experience. It is worth considering for beginners and casual investors who value simplicity and security in a modern staking platform.

Zengo is a crypto staking platform built on a keyless security model that removes seed phrases, making it easier for novices to stake digital assets without fear of losing access. The platform is backed by reputable investors and emphasizes a secure, safer approach to managing assets.

I trust Zengo based on its transparent encryption processes and positive reputation in the wider market. The team behind the service has over a decade of experience in cryptography and fintech, which gives Zengo strong credibility. This tool’s reliability comes from its real-time account protection and encrypted backup protocols. It is best for casual investors, mobile users, and beginners seeking an approachable way to enter crypto staking without sacrificing safety.

Zengo Standout Features

- Keyless Security: Removes seed phrase risks via encrypted multi-party computation.

- Biometric Login: Uses face or fingerprint for quick secure access.

- Non-custodial Wallet: Allows full user control without third-party custody.

- Automatic Backups: Encrypted backups synced to cloud for easy account recovery.

- Multi-Asset Support: Stake multiple cryptocurrencies within one intuitive interface.

- Real-time Alerts: Sends notifications on all staking activity immediately.

- Multi-sig Technology: Requires multiple signatures enhancing transaction security.

Read Zengo Wallet Review

Zengo Pros

- We appreciate that setup is perfectly smooth and intuitive.

- Account recovery feels safer than old-school seed phrases.

- The interface is friendly for new staking beginners.

Zengo Cons

- Customer service can be slow during high demand.

- Backup cloud option may worry those fearing third-party servers.

Visit: https://zengo.com/

4) Binance

Expert Insights: Why Consider Binance?

Binance sits atop global staking because it blends competitive yields with deep liquidity. The exchange is backed by robust infrastructure that helps even entry-level investors earn passive rewards effortlessly.

Binance launched in 2017 and rapidly earned trust for its rigorous security measures, including SAFU insurance for user funds. The platform follows a rigid compliance framework and stores most assets in cold wallets, reducing breach risk. Regulators across multiple jurisdictions now recognize its operational standards, reinforcing its reputation for reliability.

First-time stakers appreciate the clear interface, while seasoned traders enjoy integrated trading, lending, and DeFi gateways. I value how the dashboard presents real-time yield data transparently. For anyone seeking a perfectly balanced mix of security, liquidity, and diverse staking options, Binance offers an all-in-one environment that scales with user experience.

Binance Standout Features

- Auto-Invest: Schedule recurring buys that funnel directly into staking pools.

- Locked Staking: Higher fixed yields when funds remain staked for set terms.

- Flexible Staking: Withdraw anytime without losing already-accrued rewards.

- Launchpool Access: Farm new tokens by staking BNB or stablecoins early.

- SAFU Fund: Exchange-financed reserve covers extreme security incidents.

- Liquid Swap: Convert staked assets instantly through built-in liquidity pools.

- DeFi Wallet Bridge: Transfer staked tokens to on-chain wallets seamlessly.

Binance Pros

- Binance offers diverse staking yields across many coins.

- Fees stay low, aiding small portfolios.

- I receive daily reward distributions without delay.

Binance Cons

- Platform interface overwhelms absolute beginners initially.

- I notice geographic restrictions limit services in some regions.

Visit: https://www.binance.com/en

5) Kraken

Expert Insights: Why Consider Kraken?

Kraken is one of the longest-running names in the crypto industry, known for maintaining trust through multiple market cycles. For traders seeking a platform backed by strong credibility, Kraken represents a reliable entry point into digital asset staking and trading.

Kraken is a global cryptocurrency exchange founded in 2011, making it one of the earliest platforms to serve retail and institutional investors. Over the years, it has earned a reputation for its security-first philosophy and transparent operations, values that many competitors struggled to maintain during volatile markets. The exchange has consistently positioned itself as a platform backed by compliance and regulatory awareness, ensuring users can engage with crypto while minimizing unnecessary risks.

Personally, I have always viewed Kraken as a safe harbor during uncertain times in the market. Its track record of stability speaks volumes about its long-term vision and user protection strategy. Kraken is perfectly suited for beginners who want a straightforward path into crypto staking, as well as seasoned traders who appreciate reliability over hype-driven offerings.

Kraken Standout Features

- Global Reach: Available to users in more than 190 countries worldwide.

- Regulatory Compliance: Operates under strict global financial and crypto regulations.

- Margin Trading: Access to leveraged trading for experienced users with higher risk appetite.

- Fiat Gateways: Supports deposits and withdrawals in major world currencies.

- Cold Storage: Majority of user funds kept offline in secure environments.

- NFT Marketplace: Native platform for buying and selling non-fungible tokens.

- Staking Rewards: On-chain staking options for multiple supported cryptocurrencies.

- Educational Resources: Knowledge hub offering guides, research, and insights for beginners.

Kraken Pros

- Kraken offers consistent uptime during high market volatility.

- I appreciate the wide choice of supported fiat currencies.

- Staking rewards are competitive compared with other large exchanges.

Kraken Cons

- Trading fees can feel high for smaller volume transactions.

- I experienced delays in verification during peak market demand.

Visit: https://www.kraken.com/

6) Lido

Expert Insights: Why Consider Lido?

Lido is one of the most trusted names in crypto staking. It offers investors a reliable way to participate in staking without managing complex infrastructure. Those seeking a balanced approach to growth and convenience will find it perfectly positioned.

Lido has emerged as a leading solution in the world of crypto staking, providing a secure and accessible gateway for users to earn rewards from their digital assets. It is backed by a strong community of developers and validators, ensuring that operations remain transparent and trustworthy. The platform is designed to reduce barriers for everyday investors who want to stake without running their own validator nodes.

Its security philosophy emphasizes decentralization and the mitigation of single points of failure, building confidence among both newcomers and seasoned crypto holders. From my perspective as a trader, I see Lido as a dependable tool that simplifies staking in a market often viewed as complex. For users seeking a reliable, user-friendly, and widely adopted staking option, Lido is perfectly suited.

Lido Standout Features

- Ethereum Staking: Stake ETH without needing to run validator hardware.

- Liquid Staking: Receive stETH tokens instantly representing your staked balance.

- Multichain Support: Access staking options across Ethereum, Solana, and Polygon.

- Non-custodial Model: Assets remain under user control through secure contracts.

- Decentralized Governance: DAO structure ensures community-led protocol decisions.

- Validator Network: Diverse, professional operators maintain protocol security and uptime.

- Seamless Integration: Compatible with major wallets, DeFi apps, and exchanges.

Lido Pros

- I find staking easy without worrying about technical setups.

- Strong community backing adds confidence in long term reliability.

- Simple user interface makes onboarding for beginners less intimidating.

Lido Cons

- I sometimes feel fees reduce my overall staking yield.

Visit: https://lido.fi/

Best Crypto Staking Platforms Comparison

| Feature | Uphold | Pionex | Zengo | Binance | Kraken | Lido |

| Best For | Beginners & multi-asset investing | Automated trading + staking | Security-focused mobile users | High APY hunters & active traders | US-compliant staking | ETH liquid staking |

| Supported Cryptos | (ETH, ADA, DOT, SOL etc.) | 20+ | (ETH, BTC, stablecoins) | 100+ | 15+ | ETH, stETH |

| Minimum Staking | Low (as little as $1) | Low entry | No minimum | Very low | Depends on asset | Requires ETH deposit |

| APY Range | 3–12% | 5–15% | 6% ETH staking | Up to 20% | 3–12% | 4–5% ETH |

| Payout Frequency | Monthly | Daily | Flexible | Daily/Weekly | Weekly | Continuous |

| Lock-up Flexibility | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ❌ |

What are the best crypto staking platforms in 2026?

Some of the top crypto staking platforms worth considering in your research include Uphold, Pionex, Zengo, and others. Each offers unique staking options, varying reward rates, supported cryptocurrencies, and features such as liquid staking, flexible or fixed lock-ups, and exclusive benefits for token holders. We’ve compiled a list of leading staking platforms by evaluating key factors like reward potential, custody format, withdrawal rules, minimum staking requirements, fees, and overall user experience.

How Did We Choose Best Crypto Staking Platforms?

Crypto staking platforms continue to expand rapidly and choosing the right ones often feels overwhelming. Our experts analyzed platforms deeply to ensure reliable returns, secure environments, and consistent user-first features. The goal was to create content that is accurate, helpful, and based on updated industry performance.

- Security & Compliance: We made sure to shortlist platforms offering strong encryption, regulatory alignment, and reliable protection in order to ensure user trust.

- Staking Rewards: Our team chose platforms based on competitive APY, flexible options, and transparent payout structures according to current performance data.

- User Experience: We chose based on simple dashboards, smooth navigation, and hassle-free setup so you can stake with ease.

- Supported Assets: The experts in our team selected platforms offering versatile crypto support which is great for expanding long-term staking strategies.

- Lock-in Flexibility: We chose based on adaptable lock durations typically offering both fixed and fluid options which helps you plan investments.

- Reputation & Reliability: Our team chose platforms with strong community feedback and consistent uptime because it is important for stable performance.

Recommended Read:

- Best Crypto Mining Apps for Android

- Best Tradingview Alternatives

- Most Frequent Cryptocurrency Scams

Best Platforms for Different Types of Investors

| Investor Type | Recommended Platform | Why It’s a Good Fit |

| Beginners | Zengo | Intuitive, keyless wallet with strong security, making staking simple for newcomers. |

| Mobile-First Investors | Uphold | Easy mobile app, transparent fees, and access to a wide range of assets. |

| Yield Seekers | Binance | Extensive staking choices, flexible terms, and competitive annual percentage yields (APYs). |

| Long-Term Holders | Kraken | Regulated exchange with consistent payouts and a strong compliance record. |

| Automated Traders | Pionex | Built-in trading bots plus staking features, ideal for active and strategic investors. |

| Decentralization Advocates | Lido | Leading liquid staking protocol, offering Ethereum staking without locking assets. |

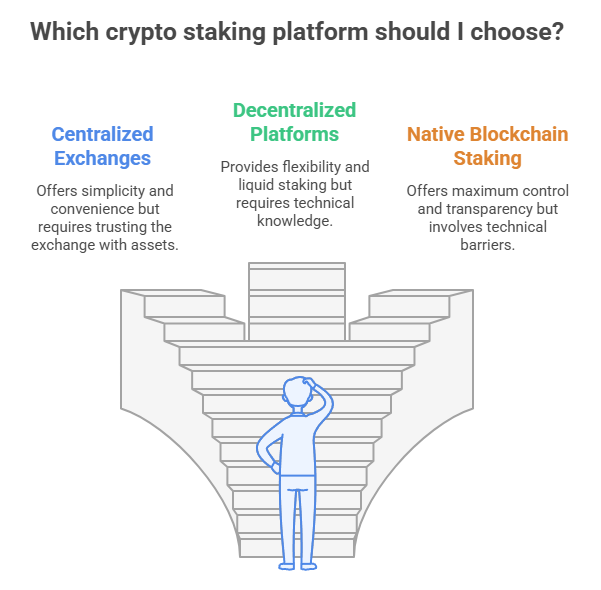

Types of Crypto Staking Platforms

Crypto staking platforms generally fall into a few main categories, each with its own benefits, risks, and accessibility levels. Understanding these types can help investors choose the best option for their goals and risk tolerance.

1. Centralized Exchanges (CEXs):

Platforms like Binance, Coinbase, and Kraken make staking simple by handling the technical setup for users. They typically offer flexible or fixed staking terms, but users must trust the exchange with custody of their assets. While convenient, this approach carries counterparty risks.

2. Decentralized Platforms (DeFi):

Protocols such as Lido or Rocket Pool allow users to stake directly through smart contracts. These services often provide liquid staking tokens, giving investors more flexibility. However, they require more technical knowledge and expose users to smart contract vulnerabilities.

Read for more information: List of Best Defi Stacking Platforms

3. Native Blockchain Staking:

Some investors prefer to stake directly via a blockchain’s official wallet or validator. This method offers maximum control and transparency but may involve higher technical barriers and lock-up periods.

Why Investors Choose Crypto Staking

Many investors are drawn to crypto staking because it offers a way to earn passive income while supporting blockchain networks. Instead of leaving digital assets idle in a wallet, staking allows holders to lock up their coins to help validate transactions and maintain network security. In return, they receive regular rewards—often paid in the same cryptocurrency—similar to earning interest.

Compared to traditional savings accounts, staking can deliver higher yields, though with greater risk. For long-term holders, it’s an attractive option to grow their portfolios without constant trading. Additionally, staking reinforces trust in decentralized ecosystems by directly contributing to network stability, making it a popular choice for investors who want both returns and involvement in blockchain innovation.

Risks and Limitations You Should Know Before Staking

Staking rewards look appealing, yet the process carries hidden risks and practical limits every investor should evaluate first.

- Market swings can wipe out rewards if token price falls faster than yields.

- Mandatory lock-up and lengthy unbonding periods reduce liquidity, limiting quick access to funds.

- Poor validator performance or malicious behavior may trigger slashing, permanently reducing your principal.

- Downtime penalties hit if your node goes offline, shrinking effective yield.

- Smart-contract bugs on DeFi staking pools can lead to hacks and unrecoverable asset loss.

- High token inflation can dilute returns, meaning real gains might lag headline APY figures.

- Regulatory uncertainty persists; some jurisdictions classify staking rewards as taxable income or securities.

- Centralized platforms add custodial risk—withdrawals may freeze during outages or insolvency.

- Opportunity cost arises because locked tokens cannot be redeployed for trading, lending, or farming.

- Complex setup procedures increase the chance of user error, potentially causing missed rewards or losses.

Verdict: Which is the Best Crypto Staking Platform?

After thorough analysis, I selected these three platforms because they offer reliability, innovation, and strong user value in the evolving world of crypto staking. They represent the best current opportunities.

- Uphold: A trusted platform with transparent staking rewards and seamless integration across multiple assets, making it highly appealing for both beginners and experienced investors.

- Pionex: I value its unique keyless security and user-friendly design, which combine to deliver an unmatched balance of safety and simplicity.

- Binance: With industry-leading liquidity and extensive staking options, it continues to provide users with diverse opportunities and future-oriented growth potential.

FAQs:

Is staking the same as mining?

No. Staking secures proof-of-stake blockchains by locking tokens to validate transactions. Mining secures proof-of-work chains using computing power and energy, requiring specialized hardware.

Which platforms offer the highest staking rewards?

Rewards vary by coin and platform. Typically, Uphold, Zengo, and Kraken offer competitive rates, but decentralized options like Lido often provide higher yields.

What’s the difference between locked and flexible staking?

Locked staking requires committing tokens for a set period, often with higher rewards. Flexible staking allows withdrawals anytime but usually offers lower yields.

What happens if a staking platform shuts down?

If a platform closes, funds may be frozen or lost depending on custody arrangements. Choosing regulated, transparent providers greatly reduces this potential risk.

How do I know if a staking platform is safe?

Check for licenses, independent audits, transparent terms, and strong security practices. Platforms with a solid reputation and user protections inspire greater trustworthiness.

How important are fees in staking platforms?

Fees directly impact rewards. High commission rates reduce earnings. Always compare fees alongside reward rates and platform security before choosing where to stake.

Disclaimer: CoinBlockLab is reader-supported. We may earn a commission from partner links, but this does not affect our independent reviews.