Key Takeaway: Crypto trading bots automate rules and react faster than humans. Popular options include Pionex, Cryptohopper, 3Commas, and Coinrule today as well. Used correctly, they enforce discipline and capture many small edges.

- Bots follow predefined strategies like grid, DCA, arbitrage, and rebalancing.

- Success depends on risk controls, position sizing, and realistic profit targets.

- Backtesting and paper trading reduce surprises before risking real capital.

- Fees, slippage, and downtime can erode gains more than expected.

- API key security, exchange reliability, and regulations matter significantly today.

Choosing the wrong bot can hurt you more than help. Poor code or shady operators can freeze funds or misfire. Unvetted bots may overtrade, chase noise, and magnify losses during volatility. Hidden fees and slippage quietly drain performance over long periods. Weak security exposes API keys and invites account takeovers too. Poor uptime or rate limits can miss crucial market moves. I suggest paper testing first, then scaling cautiously and slowly. I also recommend reviewing strategies under multiple market regimes carefully. This guide highlights trusted tools to avoid pitfalls and offers honest reviews.

Top AI Crypto Trading Bots Reviewed

Here are the top crypto trading bots I picked for you:

- Pionex: Built-in bots, competitive fees, and strong liquidity for automation across pairs.

- Cryptohopper: Cloud-based automation, marketplace strategies, and robust backtesting tools for flexibility.

- Bitsgap: Unified interface, smart order types, and powerful grid trading across exchanges.

- WunderTrading: Copy trade engines, TradingView integration, and portfolio automation features for convenience.

- Binance: Native bots, deep liquidity, and advanced order routing options for execution.

- CryptoRobotics: Visual terminals, algorithmic strategies, and alerts for systematic trading management needs.

- Coinrule: No-code rules, templates, and educational tips for beginners getting started.

- Growlonix: Multi-exchange execution, smart rebalancing, and detailed performance tracking dashboards included.

- 3Commas: Strategy builders, smart trade terminals, and mature copy trading ecosystems.

- Octobot: Open-source framework for customizable bots and transparent strategy development enthusiasts.

Disclaimer: Cryptocurrency investments are volatile and subject to market risks. The portfolio tracker tools listed are for informational purposes only and do not constitute financial advice.

What’s the Best Crypto Trading Bot in 2025?

| Platform | Supported Assets | Security Features | Target User | CoinBlockLab Rating |

| Pionex | 16 built-in bots, grid & DCA trading, arbitrage | Licensed MSB (U.S.), exchange-grade custody | Beginners & passive investors | 4.7 / 5 |

| Cryptohopper | Strategy builder, AI signals, copy trading | 2FA, cloud encryption, OAuth | Intermediate to advanced traders | 4.5 / 5 |

| Bitsgap | Grid bots, arbitrage, portfolio tracking | AES-256 API encryption, 2FA | Multi-exchange traders | 4.2 / 5 |

| WunderTrading | Copy trading, futures & DCA automation | Non-custodial, API encryption | Copy traders & signal followers | 4.0 / 5 |

| Binance | Spot, futures, staking, auto-invest | ISO/IEC 27001 certified, SAFU fund | All-level traders (beginner to pro) | 3.9 / 5 |

| CryptoRobotics | Smart order routing, bots, analytics | Cloud encryption, API isolation | Technical traders | 3.8 / 5 |

| Coinrule | No-code rule builder, 10+ exchanges | AES encryption, 2FA | Beginners learning automation | 3.6 / 5 |

| Growlonix | Multi-exchange bots, signal integration | Basic encryption, limited audits | Budget users | 3.5 / 5 |

| 3Commas | SmartTrade, DCA, copy trading | API encryption, IP whitelisting, 2FA | Experienced traders & portfolio managers | 3.5 / 5 |

| Octobot | Open-source custom bots, strategy scripting | Local control, transparent codebase | Developers & advanced users | 3.4 / 5 |

1) Pionex

Expert Insights: Why Consider Pionex?

Pionex is one of the world’s first exchanges to integrate built-in crypto trading bots. It offers an automated approach to trading that appeals to both beginners and seasoned investors seeking consistent market participation without constant monitoring. It stands out as a trusted, cost-effective option for algorithmic trading enthusiasts.

Pionex is a Singapore-based cryptocurrency exchange launched in 2019 and is backed by prominent investors such as Gaorong Capital and Shunwei Capital. The platform aggregates liquidity from major exchanges like Binance and Huobi, ensuring high execution quality and minimal slippage. Known for its security and compliance framework, Pionex operates under FinCEN’s MSB license, showcasing its strong regulatory footing and transparency.

Its core philosophy emphasizes accessibility and automation, offering users pre-built trading bots that run seamlessly in any market condition. I find Pionex perfectly suited for individuals seeking a balance between automation and manual control. It serves best for users who wish to simplify their trading strategy, reduce emotional bias, and benefit from continuous, rule-based execution.

Pionex Standout Features

- Grid Trading Bot: Automates buy-low, sell-high strategy in volatile markets

- DCA Bot: Enables regular, scheduled investments to lower average costs

- Smart Trade Terminal: Supports trailing stop and take-profit orders efficiently

- Spot-Futures Arbitrage Bot: Locks in risk-free profit opportunities using dual positions

- Infinity Grid Bot: Adjusts grid range dynamically to follow price trends

- Leverage Grid Bot: Multiplies exposure while maintaining structured order management

- Rebalancing Bot: Keeps portfolio ratios aligned with custom asset allocations

- Backtesting Tool: Simulates strategy performance before real market execution

- Cloud Operation: Bots run 24/7 even when users are offline

- Exchange Aggregation: Combines liquidity from multiple top-tier exchanges

Pros

- We appreciate the built-in bots that save setup time.

- I like the zero trading fees for spot grid bots.

- Reliable liquidity ensures smooth trade execution always.

- Strong security measures protect funds effectively.

Cons

- I find the limited fiat withdrawal options inconvenient.

- Some advanced bots may confuse beginner users.

2) Cryptohopper

Expert Insights: Why Consider Cryptohopper?

Cryptohopper stands out as one of the most adaptive crypto trading bots for users seeking automation in a volatile market. It bridges manual strategy with algorithmic precision, allowing traders to engage smarter without constant screen time.

Cryptohopper is a cloud-based crypto trading bot founded in 2017 by two Dutch brothers passionate about simplifying algorithmic trading. It operates around the clock, automating trades on major exchanges like Binance, Coinbase, and Kraken. The platform emphasizes reliability and user safety, implementing encryption and secure APIs for all connected exchanges.

Its philosophy centers on giving both novice and advanced traders the ability to automate strategies with minimal coding. From my experience, Cryptohopper’s learning curve is gentle, supported by educational resources and a simulation mode for practice.

This tool is ideal for users who wish to trade systematically, reduce emotional decisions, and leverage data-backed strategies to improve long-term consistency in volatile markets.

Cryptohopper Standout Features

- Cloud Automation: Continuous 24/7 trading without manual intervention.

- Exchange Integration: Supports top exchanges like Binance, Kraken, and Coinbase.

- Strategy Designer: Build trading strategies without coding experience.

- Copy Trading: Mirror expert traders’ strategies instantly and automatically.

- Backtesting: Simulate strategy performance with historical market data.

- Trailing Stop-Loss: Protect profits dynamically as market prices move.

- Technical Indicators: Access over 130 built-in market analysis tools.

- Paper Trading: Practice strategies risk-free in simulated environments.

- Marketplace Access: Buy or sell trading templates and algorithms easily.

- Arbitrage Bot: Exploit price differences across exchanges automatically.

- Real-Time Notifications: Receive instant alerts for executed trades or signals.

Pros

- It automates trades efficiently without needing constant supervision.

- I found its paper trading feature extremely useful for testing ideas.

- It offers diverse strategies suitable for both beginners and pros.

- The marketplace provides great flexibility for ready-made trading setups.

Cons

- I found the subscription tiers a bit complex for first-time users.

- It may feel overwhelming initially due to numerous configuration options.

Visit: https://www.cryptohopper.com/

3) Bitsgap

Expert Insights: Why Consider Bitsgap?

Bitsgap helps simplify bot-driven crypto execution across exchanges. It suits beginners seeking structure and traders demanding consistency through volatile markets. For those prioritizing discipline, unified oversight, and measured automation, this platform can anchor a scalable, rules-based approach without overwhelming first-time users.

Bitsgap is a non-custodial crypto automation platform connecting major exchanges. Your assets stay on exchanges, linked by encrypted API keys. That reduces counterparty exposure versus depositing funds elsewhere. The company emphasizes a “security first” philosophy and transparent safeguards. Independent review portals and Trustpilot show broad, recent user feedback.

I value that public footprint when evaluating operational reliability. Bitsgap’s reputation centers on accessible onboarding and responsible risk framing. The platform suits newcomers who want guided automation with safety rails. It also fits active traders needing centralized management of multiple venues. Experienced users will appreciate policy clarity around data handling and credentials. I find its stance on custody and keys especially reassuring for risk control. Overall positioning targets pragmatic users who want structure without vendor lock-in.

Bitsgap Standout Features

- Exchange Connectivity: Encrypted API links keep funds at connected exchanges.

- Grid Bots: Parameterized grid execution for range-bound market conditions.

- DCA Bots: Automated averaging to smooth entries across volatile moves.

- Futures Bots: Automation support for derivative markets where available.

- Smart Orders: Advanced order types for precise trade management workflows.

- Backtesting: Historical simulations to validate bot parameters before deployment.

- Trailing Controls: Trailing up and down functions adapt to trend continuation.

- Stop-loss and take-profit: Predefined exits help control downside and targets.

- bitsgap.com

- Demo Mode: Paper trading environment for risk-free practice and learning.

- AI Assistant: Guided configuration support for bot setup and allocation.

- Profit Reinvestment: Option to compound DCA bot profits systematically.

Pros

- Onboarding feels straightforward for first-time automation users.

- Non-custodial design reassures me about counterparty risks.

- Centralized management reduces platform switching fatigue.

- I like the transparent security documentation online.

Cons

- Results vary widely with market regimes and volatility.

- I saw AI pair suggestions misfit lower liquidity sometimes.

Visit: https://bitsgap.com/

4) WunderTrading

Expert Insights: Why Consider WunderTrading?

WunderTrading deserves attention if you want automation without rebuilding your playbook. It helps newer traders transition from manual decisions to disciplined, rules-driven execution while keeping workflow familiar and straightforward.

WunderTrading connects to supported exchanges through API keys, not deposits, aligning with a non-custodial philosophy that many traders prefer for risk control. The platform emphasizes permission-limited keys and IP whitelisting guidance, reflecting a security-first mindset. Reputation-wise, public feedback shows solid satisfaction scores alongside candid critiques, which is what I look for when evaluating longevity. The company’s help articles explain setup clearly, reducing uncertainty for first-time bot users.

You keep funds on the exchange, while WunderTrading transmits orders via keys you configure. This separation of custody and execution reduces single-platform failure exposure. It suits beginners exploring automation, intermediate users scaling strategies, and advanced traders standardizing signals from external analytics. I value tools that document operational safeguards and provide transparent pricing. WunderTrading meets those baseline expectations without forcing a proprietary custody model.

WunderTrading Standout Features

- TradingView Bot: Converts external alerts into executable orders across connected exchanges.

- DCA Bot: Automates staggered entries to smooth volatile price swings.

- Grid Bot: Structures range-based orders for sideways market harvesting opportunities.

- Market Neutral Bot: Targets spread capture independent of market direction exposure.

- Arbitrage Bot: Explores cross-market pricing discrepancies for systematic execution.

- Copy-Trading: Follows selected strategies while retaining exchange-level asset custody.

- Paper Trading: Simulates strategies with live data before risking capital.

- Smart Trading: Consolidated order management with conditional exits and risk controls.

- Multi-API Management: Operates several exchange connections from a single dashboard.

- Pump Screener: Monitors unusual moves to trigger predefined responses quickly.

- Crypto Trade Signals: Integrates external signals into standardized bot actions.

- Trading Terminal: Centralizes manual oversight alongside automated strategy controls.

Pros

- Pricing includes a lifetime free tier for testing phases.

- Setup felt quick with step-by-step help articles.

- Non-custodial model keeps funds on your own exchange.

Cons

- Higher-tier subscriptions may increase ongoing costs.

Visit: https://wundertrading.com/en

5) Binance

Expert Insights: Why Consider Binance?

Binance is a go-to venue when you prioritize breadth, liquidity, and scale. For newcomers exploring automated crypto strategies, starting on a deep, active marketplace reduces friction, improves price discovery, and supports sustainable learning curves without forcing premature complexity or commitment.

Binance launched in 2017 and quickly became a dominant exchange. Its reliability has matured through years of heavy volumes and rapid iteration. Security emphasizes layered defenses, segregated custody practices, incident response readiness, and investor protection reserves. The platform’s reputation stems from deep order books, broad market coverage, and consistent uptime during routine sessions.

I have seen beginners gain confidence because onboarding feels straightforward and stable. The broader community views it as a practical hub for trading education and execution. For users with minimal experience, it offers a structured environment to observe markets, test simple strategies, and scale gradually. For intermediate traders, operational depth supports more advanced risk frameworks without immediately demanding specialist tools. We recommend it for learners, part-time traders, and disciplined investors seeking a familiar starting point.

Binance Standout Features

- Spot Markets: Extensive listings for diversified exposure across major and emerging assets

- Derivatives Suite: Perpetuals and dated futures with transparent funding and margin mechanics

- Margin Trading: Tiered borrowing limits and risk controls for flexible capital deployment

- Grid bots: Built-in automation templates supporting rules-based market-making workflows

- Copy Strategies: Curated strategy mirrors enabling beginner exploration of systematic approaches

- Fiat on-ramps: Multiple payment rails supporting regional deposit and withdrawal preferences

- Launchpad Access: Token sale participation with standardized processes and eligibility verification

- Earn Products: Time-bound yield programs with clear terms and redemption schedules

- Proof-of-reserves: Periodic attestations demonstrating asset coverage and custodial segregation

Pros

- Order books feel deep during normal trading hours.

- Spreads are usually tight on large market pairs.

- I experienced fast fills even during moderate volatility.

- Educational content helps beginners navigate first trades confidently.

- Mobile app sync keeps my workflows consistent anywhere.

Cons

- Regional availability varies and sometimes limits feature access

- I found identity verification slow during peak demand

Visit: https://www.binance.com/en

6) CryptoRobotics

Expert Insights: Why Consider CryptoRobotics?

CryptoRobotics provides a unified platform for automated crypto trading that simplifies decision-making for both beginners and professionals. It offers algorithmic precision and data-driven execution, allowing users to trade confidently across multiple exchanges without needing deep technical skills.

CryptoRobotics is a comprehensive crypto trading terminal founded to make algorithmic trading accessible to everyone. It has steadily gained trust within the crypto community due to its transparent operations and strong focus on user security. The platform connects to leading exchanges, enabling seamless management of portfolios through advanced automation.

Its security model emphasizes encryption and non-custodial principles, meaning users always retain full control over their funds. With an intuitive interface, it supports traders at all experience levels, from casual investors to active arbitrageurs. I appreciate how it balances sophistication with simplicity, making complex trading tools easy to understand. For those seeking a reliable, cloud-based solution to streamline strategy execution and minimize emotional trading, CryptoRobotics stands out as a well-regarded choice in the automated trading space.

CryptoRobotics Standout Features

- Exchange Integration: Connects with major exchanges like Binance, OKX, and KuCoin.

- Cloud-Based Platform: Enables secure, always-online trading with no manual downtime.

- Trading Bots: Offers grid, DCA, and arbitrage bots for flexible strategies.

- Copy Trading: Lets users follow expert traders and mirror their positions.

- Market Analytics: Provides real-time price tracking and AI-assisted insights.

- Risk Management: Built-in tools to automate stop-loss and take-profit orders.

- Strategy Builder: Drag-and-drop editor for creating automated trading logic.

- API Security: Uses encrypted keys with layered authorization for added safety.

- Portfolio Tracking: Consolidates asset balances and performance metrics in one dashboard.

- Backtesting Engine: Allows simulation of bot performance using historical data.

- Multi-Exchange Arbitrage: Automates profit capture from price differences across exchanges.

Pros:

- It is very easy to set up for beginners.

- We found its copy trading system quite reliable.

- The analytics dashboard feels clean and informative.

- I like that trading remains secure through API protection.

- It supports multiple exchanges under one platform.

- Performance remains stable even during market volatility.

Cons:

- Some exchanges take longer to sync account data.

- I found the mobile app slightly slower than the desktop version.

Visit: https://cryptorobotics.ai/tradingbot/

7) Coinrule

Expert Insights: Why Consider Coinrule?

In volatile, always-on crypto markets, disciplined automation can reduce emotion and enforce consistency. Coinrule deserves a look if you want structure, transparent guardrails, and a gentler path into bot-driven execution without reinventing your entire workflow overnight.

Coinrule is a London-based crypto automation platform launched to help retail traders translate ideas into executable rules. Its reliability pitch centers on exchange-connected trading that never requests withdrawal permissions, keeping custody at your exchange while bots place orders via API. The company’s security materials emphasize trading-only keys and two-factor protection, reflecting a conservative permissions model.

Reputation is solid for a consumer tool: Trustpilot reviewers broadly highlight helpful support and accessible onboarding, while industry press has covered its growth and beginner-friendly entry tier. I view it as a “training-wheels to intermediate” bridge rather than a quant lab. It suits first-timers who want guided automation, side-hustle traders who value time, and portfolio builders who prefer rules over screen-watching. I have seen newcomers adopt it to standardize entries, exits, and scheduling with less stress.

Coinrule Standout Features

- Rule Builder: Visual “if-this-then-that” logic for composing trading conditions.

- Templates Library: Preconfigured strategies to jumpstart rule creation and deployment.

- Paper Trading: Simulated execution to validate ideas without risking capital.

- Backtesting: Historical rule checks to gauge behavior before committing funds.

- Exchange Connectivity: API links to multiple major centralized trading venues.

- API Permissions: Trading-only keys; withdrawal rights remain disabled by design.

- Alerting: Notifications on rule triggers and executions for rapid awareness.

- Scheduling: Time-based rule runs aligned to market sessions or routines.

- Risk Controls: Conditional exits, including stop and target logic within rules.

- Portfolio Scope: Run multiple rules across assets without constant screen time.

- Rule Versions: Save, adjust, and redeploy iterations as market conditions evolve.

- Dashboard: Centralized monitoring for active rules, fills, and status messages.

Pros:

- Helpful support responses arrive quickly for most issues.

- Onboarding feels approachable for first automated strategies.

- I liked starting on a free beginner tier.

- Clear security stance reduces custody and withdrawal worries.

Cons:

- Advanced order options feel limited in some workflows.

- I found higher tiers pricey for casual traders.

Visit: https://coinrule.com/

8) Growlonix

Expert Insights: Why Consider Growlonix?

Growlonix stands out as a dynamic crypto trading bot platform built to simplify automated trading. For traders aiming to enhance strategy execution with speed, precision, and minimal manual effort, Growlonix offers a reliable environment designed for both beginners and evolving market participants.

Growlonix is an intelligent cryptocurrency trading automation platform that connects with major exchanges to help users execute trades efficiently. Known for its consistent uptime and transparent operation, it is widely respected among traders who value disciplined automation. The platform emphasizes security through API key encryption and exchange-level integration, ensuring funds remain protected at all times.

Growlonix also prides itself on providing dependable support and a clear interface, which helps new users navigate the complexities of trading automation easily. From my own experience, I found its order management tools both responsive and intuitive. Whether you are a casual investor exploring passive income or a seasoned trader refining complex strategies, Growlonix adapts to various trading goals and levels of experience.

Growlonix Standout Features

- Exchange Integration: Seamless connectivity with multiple top-tier crypto exchanges.

- Strategy Builder: Drag-and-drop interface for creating algorithmic trading strategies.

- Cloud-Based Operation: Continuous trading without local device dependency.

- Real-Time Monitoring: Instant updates on trades, balances, and performance metrics.

- Backtesting Engine: Historical data testing to optimize strategy efficiency.

- Portfolio Tracker: Unified dashboard displaying diversified exchange accounts.

- Smart Order Execution: Split-order algorithms to minimize market slippage.

- Arbitrage Functionality: Cross-exchange price gap trading for advanced users.

- API Security: Encrypted access keys stored under enterprise-level protection.

- Multi-Currency Support: Trading enabled for numerous crypto and stablecoin pairs.

- Community Marketplace: Shared strategies from experienced traders for public use.

- Mobile Access: Manage bots and portfolios directly from mobile devices.

Pros:

- Backtesting helps refine strategies effectively.

- Automation saves time during volatile sessions.

- Comprehensive integration with multiple exchanges.

Cons:

- I noticed occasional lag during peak traffic times.

- Mobile version lacks some advanced customization options.

Visit: https://www.growlonix.com/

9) 3Commas

Expert Insights: Why Consider 3Commas?

3Commas is a powerful and trusted crypto trading automation platform used by both beginners and professionals. It helps traders execute strategies efficiently and manage portfolios across multiple exchanges. For those seeking smarter, data-driven trading, 3Commas offers a proven edge in volatile crypto markets.

3Commas is a leading crypto trading bot platform designed to simplify automated trading for retail and professional investors alike. Established in 2017, it has gained a strong reputation for reliability, transparency, and robust security measures. The platform emphasizes consistent profitability through automation rather than speculation, offering traders tools to create, backtest, and deploy strategies with minimal manual input.

Its architecture is built around exchange API integrations, ensuring funds always remain on the user’s chosen exchange for enhanced safety. 3Commas uses encryption and account-level permission controls to safeguard user data and trade execution. I personally find its design intuitive, especially for those transitioning from manual to algorithmic trading. It is particularly well-suited for beginners looking to automate basic strategies and intermediate traders who want access to advanced analytics.

3Commas Standout Features:

- Smart Trading Terminal: Unified dashboard to manage trades across multiple exchanges.

- Grid Bot: Automates buy-low, sell-high cycles in volatile markets.

- DCA Bot: Uses dollar-cost averaging to smooth out entry prices.

- Options Bot: Simplifies complex derivatives trading for accessible risk management.

- Paper Trading: Enables users to test strategies without using real funds.

- Copy Trading: Allows users to follow top-performing traders’ strategies automatically.

- API Integration: Secure connectivity with major exchanges like Binance, OKX, and Coinbase.

- TradingView Integration: Enables strategy automation from TradingView alerts.

- Mobile App: Real-time monitoring and control of bots from any device.

- Smart Portfolio Tracking: Consolidates and visualizes holdings from multiple platforms.

- Marketplace: Users can browse, rent, or share custom-built trading bots.

- Profit and Loss Analytics: Provides detailed performance breakdowns for each strategy.

Pros

- It integrates easily with most major exchanges.

- I appreciate its user-friendly setup and clean interface.

- Paper trading helps build confidence before using real funds.

- It offers consistent updates and community-driven improvements.

Cons:

- We noticed mobile notifications can occasionally lag.

- Paid tiers may feel costly for casual users.

Visit: https://3commas.io/

10) Octobot

Expert Insights: Why Consider Octobot?

Octobot is an AI-driven crypto trading bot designed for traders seeking automation and strategy refinement. It simplifies market participation for both beginners and experts, offering a reliable way to execute trades efficiently without constant monitoring or complex coding requirements.

Octobot is an open-source crypto trading bot that brings automation to digital asset trading. Launched with transparency and community-driven development, it emphasizes user control and data security. The platform integrates artificial intelligence with customizable strategies, allowing traders to automate decisions based on both technical indicators and market sentiment.

Known for its stability and privacy-focused approach, Octobot has gained a strong reputation across various crypto communities. It prioritizes user autonomy by enabling decentralized strategy execution, ensuring that private data and funds remain under personal control. I have found it to be a practical choice for traders who value transparency and flexibility. Octobot is best suited for beginners exploring automated trading as well as intermediate users seeking advanced yet accessible tools for strategy development.

Octobot Standout Features

- AI Engine: Learns from market patterns to enhance trading accuracy.

- Strategy Editor: Visual and script-based customization for trading strategies.

- Backtesting Tool: Evaluates strategies using historical data for better optimization.

- Multi-Exchange Support: Compatible with Binance, Coinbase, Kraken, and others.

- Risk Control: Built-in tools to manage exposure and stop-loss settings.

- Cloud or Local Deployment: Choose between hosted or self-managed environments.

- Notification System: Instant alerts via email, Telegram, or Discord integration.

- Open-Source Framework: Fully transparent and constantly audited by developers.

- Performance Dashboard: Real-time analytics for monitoring trade efficiency.

- Paper Trading Mode: Practice safely without risking real capital.

- Modular Design: Easily integrate third-party tools or custom plugins.

Pros:

- It is open-source and fully transparent.

- Setup is simple for new crypto traders.

- I find its strategy testing very effective.

- Good community support for troubleshooting.

Cons:

- I noticed occasional delays in order execution.

- We experienced limited exchange connectivity.

Visit: https://www.octobot.cloud/features/ai-trading-bot

What is a Crypto Trading Bot?

A crypto trading bot is an automated software program that buys and sells cryptocurrencies on your behalf. It follows preset rules, strategies, or algorithms to analyze market data and execute trades faster and more consistently than a human. Bots can run 24/7 and are often used to save time, remove emotion from trading, and take advantage of rapid price movements in the crypto market.

Why Use a Crypto Trading Bot?

Crypto trading bots offer a strategic edge by automating trades based on predefined parameters, helping traders remove emotional decision-making and react faster to market changes.

- Consistency: Bots execute trades according to preset strategies, ensuring disciplined trading behavior.

- Speed: React to market movements instantly—vital in highly volatile crypto markets.

- Efficiency: Automate repetitive actions such as rebalancing portfolios and tracking price alerts.

- Backtesting: Test strategies with historical data to refine performance before going live.

- Diversification: Manage multiple trading pairs and exchanges simultaneously.

- 24/7 Operation: Never miss opportunities due to time zones or sleep—bots trade continuously.

How to Choose the Right Crypto AI-Powered Trading Bot?

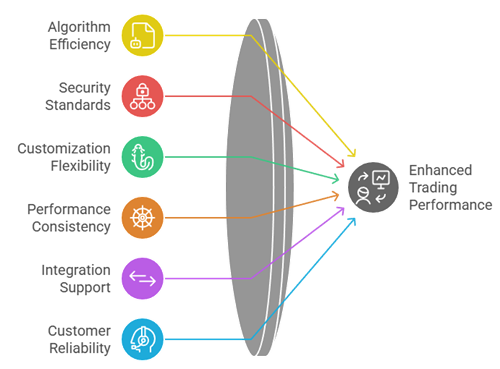

In the fast-paced world of cryptocurrency, automation powered by AI offers smarter, data-driven trading solutions. Our experts focused on accuracy, reliability, and advanced analytics to identify tools that consistently enhance trading performance. Each selection ensures user-centric experiences, helping both beginners and professionals trade efficiently and securely.

- Algorithm Efficiency: We chose based on how precisely each bot analyzes vast crypto data to make profitable, real-time decisions.

- Security Standards: Our team selected bots that ensure your funds remain safe with multi-layer encryption and reliable authentication systems.

- Customization Flexibility: We made sure to shortlist tools that allow users to adapt strategies easily and optimize for efficiency.

- Performance Consistency: Experts in our team selected bots that perform smoothly under market volatility for all users without compromise.

- Integration Support: We chose platforms offering hassle-free setup and versatile exchange compatibility to simplify trading processes effortlessly.

- Customer Reliability: Our team chose based on feedback showing responsive support that helps users resolve issues quickly and effectively.

Paid vs Free Crypto Trading Bots

Free bots are useful for practice and experimentation, while paid bots are better suited for traders who want advanced features, better performance, and reliable long-term automation. Choosing the right one depends on your budget, experience level, and trading goals.

| Feature | Paid Crypto Trading Bots | Free Crypto Trading Bots |

| Cost | Requires monthly or annual subscription; some charge based on trading volume | Completely free or open-source, though advanced plugins may cost extra |

| Features | AI-driven analytics, automated portfolio rebalancing, backtesting, and 24/7 support | Basic buy/sell automation, limited indicators, minimal customization |

| Performance & Reliability | Professional-grade infrastructure ensures faster execution and higher uptime | Dependent on community updates, may suffer from latency issues |

| Security | Employ encryption, API key protection, and customer accountability | Limited security layers; potential risks if not updated regularly |

| User Support | Access to dedicated support teams, tutorials, and documentation | Relies on online forums or community assistance |

| Best For | Experienced traders and institutions optimizing profits | Beginners experimenting with crypto automation tools |

| Example Platforms | 3Commas, Cryptohopper, TradeSanta | Gekko, Freqtrade, Zenbot |

👉 Tip: Start with a free bot to understand automation, then upgrade to a paid version once you’re confident managing strategies and risk.

Types of AI Trading Bots

AI trading bots come in several forms, each designed to automate different aspects of cryptocurrency trading. Understanding their functions helps traders choose a bot that aligns with their goals, risk tolerance, and trading style. Below are the main types of AI crypto trading bots used in the market today.

1. Arbitrage Bots

Arbitrage bots exploit price differences of the same cryptocurrency across multiple exchanges. For instance, if Bitcoin is priced lower on Binance than on Coinbase, an arbitrage bot can buy from one and sell on the other almost instantly, locking in profit. These bots rely heavily on speed, accuracy, and low latency, making them ideal for traders focused on short-term, low-risk gains. However, due to increasing market efficiency, profitable arbitrage opportunities are becoming rarer and require advanced AI to detect them in real time.

2. Trend-Following Bots

These bots use machine learning and technical analysis to identify price trends and execute trades accordingly. They often rely on indicators such as moving averages, RSI, and MACD. When an uptrend is detected, the bot buys; when the trend reverses, it sells. Trend-following bots are popular among beginner and intermediate traders because they simplify market timing and reduce emotional decision-making.

3. Market-Making Bots

Market-making bots place both buy and sell orders around the current market price to profit from bid-ask spreads. By providing liquidity, these bots earn small but consistent profits over time. AI-enhanced market-making bots can dynamically adjust their spread and order volume based on volatility, order book depth, and competitor activity. They are often used by professional traders and institutions.

4. Portfolio Rebalancing Bots

For long-term investors, portfolio rebalancing bots automatically adjust crypto allocations to maintain a desired asset mix. For example, if Bitcoin surges and overweights a portfolio, the bot can sell some BTC and rebalance into other coins. These bots help manage risk and maintain strategic diversification without manual intervention.

5. Sentiment Analysis Bots

Leveraging natural language processing (NLP), sentiment bots analyze news, social media, and market sentiment to predict price movements. They can detect shifts in public mood or breaking news events faster than human traders, allowing proactive trading decisions.

Pros and Cons of Crypto Trading Bots

| Pros | Cons |

| 1. 24/7 Trading: Bots operate nonstop, capturing opportunities even when traders are offline. | 1. No Human Intuition: Bots can’t interpret news or market sentiment like humans. |

| 2. Fast and Efficient: Execute trades within milliseconds, ideal for volatile crypto markets. | 2. Over-Reliance Risk: Markets change, and bots may fail without regular adjustments. |

| 3. Emotion-Free Decisions: Eliminates impulsive actions driven by fear or greed. | 3. Security Concerns – API connections may expose accounts to hacking if not secured. |

| 4. Backtesting Capabilities: Traders can test strategies using past data before investing. | |

| 5. Time-Saving: Automates repetitive tasks, freeing time for analysis and planning. |

Verdict

After thorough testing and market observation, I chose these three crypto trading bots for their consistency, adaptability, and innovation. They each excel in delivering performance, automation, and reliability.

- Pionex: Renowned for its built-in trading bots and low fees, Pionex empowers traders with automated precision and round-the-clock efficiency.

- Cryptohopper: I value its intelligent strategy customization, cloud-based operation, and seamless marketplace integration that simplifies professional-grade trading.

- Bitsgap: Its robust arbitrage tools and unified dashboard make managing multiple exchanges efficient, secure, and highly responsive to market trends.

FAQs

Do AI Trading Bots Really Work?

AI crypto trading bots can work effectively when configured with sound strategies and reliable data. However, results vary by market conditions, bot design, and user expertise in parameter optimization.

Are AI Trading Bots Safe and Legal to Use?

Most AI trading bots are legal and safe when used on regulated exchanges. Always verify platform credibility, follow regional compliance, and use API keys securely to protect funds.

Can You Make Money With Crypto Trading Bots?

Yes, profit is possible, but not guaranteed. Success depends on market volatility, trading strategy, bot accuracy, and disciplined risk management rather than fully automated expectations of profit.

Are Crypto Trading Bots Profitable?

Crypto bots can be profitable in trending or high-volatility markets. Consistent monitoring, backtesting, and adjusting to changing conditions are essential to maintain long-term profitability and reduce losses.

What Is the Success Rate of Crypto Trading Bots?

Success rates vary widely, typically ranging from modest gains to break-even performance. Bots succeed best when supervised, paired with solid strategies, and adapted to evolving crypto market dynamics.

What Is the Best Crypto Trading Bot?

Top contenders include, Pionex, Cryptohopper and Bitsgap each offering automated strategies, portfolio tracking, and user-friendly tools. The “best” bot depends on your goals, budget, and trading experience.

Is Cryptohopper Worth It?

Cryptohopper is worth considering for its user-friendly interface, cloud-based automation, and copy-trading options. It suits beginners and experienced traders seeking flexible, AI-assisted strategies with strong community support.