Binance Review: What Is Binance?

Binance is the world’s largest cryptocurrency exchange, known for its wide range of features, low trading fees, and extensive selection of cryptocurrencies. It caters to both beginners and experienced traders with advanced tools and various trading options.

Binance at a Glance

Binance at a Glance provides a quick overview of the exchange’s key facts and features. It highlights essential details such as its founding, leadership, global reach, and core services for traders and investors.

| Category | Details |

| Company Name | Binance Holdings Ltd. |

| Founded | 2017 |

| Founders | Changpeng Zhao (CZ), Yi He |

| CEO | Richard Teng (since late 2023) |

| Headquarters | Global (previously registered in Cayman Islands; operational hubs in Dubai, Paris, and Singapore) |

| Market Capitalization (2025) | Estimated private valuation around US $30–35 billion |

| Users / Customers | Over 170 million registered users |

| Employees | Approximately 8,000 + (as of 2025) |

| Geographic Reach | 180 + countries and regions |

| Cryptocurrencies Offered | 350 + listed cryptocurrencies globally (varies by region) |

| Core Products & Services | Spot and futures trading, staking, savings, Binance Earn, Launchpad, NFT marketplace, Binance Card, and Web3 wallet |

| Trading Fees (Advanced) | Maker 0.00–0.10% • Taker 0.02–0.10% (tiered; discounts via BNB) |

| Security / Safeguards | Secure Asset Fund for Users (SAFU), 2FA, cold wallet storage, proof-of-reserves transparency |

| Recent Developments | CEO transition from CZ to Richard Teng (2023); expansion of compliance efforts in Europe and Middle East; ongoing collaboration with regulators for licensing and transparency (2024–2025) |

What Are the Pros and Cons of Using Binance?

Binance offers a powerful platform for trading and investing in cryptocurrencies, known for its wide features and low fees. However, like any exchange, it comes with both advantages and drawbacks that users should understand before getting started.

| Pros | Cons |

| Supports over 350 cryptocurrencies and numerous trading pairs. | Faces ongoing regulatory challenges in several regions. |

| Offers some of the lowest trading fees, with extra discounts using BNB. | Interface and features can be complex for me when I’m just starting out. |

| Provides advanced trading options like spot, futures, margin, and staking. | Limited fiat access and payment methods in some countries. |

| I find it convenient to diversify my portfolio easily due to the wide range of coins available. | |

| Strong security with the SAFU fund and multi-layer protection. |

How CoinBlockLab Rated the Binance?

After an in-depth evaluation of the Binance Wallet, I’ve assessed its performance across multiple key dimensions to provide an objective and comprehensive overview. In this binance review examines security, usability, fees, supported assets, and customer support, combining hands-on testing with detailed research to ensure accuracy and fairness. The following breakdown highlights how Binance performs in each area — helping you determine whether it aligns with your trading and digital asset management needs.

| Category | Review Criteria | CoinBlockLab Rating | Testing & Findings |

| Core Wallet Offering | Features | 4.6 / 5 | Account setup and wallet functionality tested extensively. Smooth onboarding flow with support for biometric login and 2FA. Intuitive wallet dashboard with seamless crypto transfers and swaps. |

| Supported Crypto & Trading Pairs | Asset Coverage & Liquidity | 4.0 / 5 | Supports major cryptocurrencies like BTC, ETH, USDC, and BNB. However, offers fewer long-tail altcoins compared to decentralized wallets like MetaMask. |

| Supported Fiat & Deposit Methods | Fiat Coverage & Payment Integration | 4.3 / 5 | Tested multiple fiat on-ramps including credit/debit card, bank transfers, and third-party providers. Fiat support varies by jurisdiction, with smooth KYC integration. |

| Financial Aspect | Fees | 4.1 / 5 | Competitive network and swap fees. Compared with Trust Wallet and Coinbase Wallet, Binance offers better efficiency on cross-chain transactions. |

| User Experience | Ease of Use | 4.7 / 5 | Very beginner-friendly interface. Hands-on testing showed that navigation, wallet creation, and crypto purchase flows are straightforward and responsive. |

| Mobile App | 4.4 / 5 | App tested on both iOS and Android. Performance stable with fast load times and regular updates. Minimal app crashes and clear feature categorization. | |

| Customer Support | 4.2 / 5 | Live chat tested — average response time around 5 minutes. Support team helpful but lacks full 24/7 coverage across all regions. | |

| Trust & Reliability | Security Measures | 4.6 / 5 | Implements MPC (Multi-Party Computation) technology, eliminating seed phrase risk. Regular third-party audits and ISO-certified infrastructure. |

| Transparency of Operations | 4.3 / 5 | Clear and publicly available security policies. However, codebase is not open-source, limiting full community verification. | |

| Differentiators | Innovation & Unique Features | 4.5 / 5 | Standout keyless wallet with 3FA recovery system. Integrated with Binance ecosystem for seamless trading and staking. |

| Educational Resources | 4.1 / 5 | Offers tutorials and beginner guides, though less comprehensive than Binance Academy’s dedicated content portal. | |

| Final Score | Overall CoinBlockLab Score | 4.4 / 5 | Weighted score: Security (20%), Ease of Use (15%), Features (15%), and other factors evenly distributed. Demonstrates strong reliability and usability. |

At this point in my Binance review, you should have a clear understanding of the exchange’s background.

Why Choose Binance Over Other Exchanges?

Binance stands out for its combination of low trading fees, wide cryptocurrency selection, and powerful tools tailored for both beginners and professionals. Unlike many exchanges, it offers advanced trading features such as futures, staking, and savings options—all within a user-friendly interface. Its robust security measures, including two-factor authentication and SAFU insurance fund, further enhance trust. Additionally, Binance’s global presence, liquidity, and continuous innovation make it a preferred choice for crypto traders seeking reliability and growth opportunities.

What Products and Services Does Binance Offer?

Binance offers a diverse ecosystem of products and services designed for traders, investors, and blockchain enthusiasts. From simple crypto trading to advanced futures and DeFi tools, it caters to both beginners and professionals. Beyond trading, Binance provides payment solutions, staking, and Web3 access—making it a complete digital finance platform. The following are some of the key products and services offered by Binance.

- Spot Trading: Binance’s primary feature, allowing users to buy and sell cryptocurrencies instantly across hundreds of trading pairs with low fees and high liquidity.

- Futures Trading: Enables leveraged trading through perpetual and quarterly contracts, giving experienced traders more flexibility and potential for higher returns.

- Binance Earn: A collection of passive income options like staking, savings, liquidity farming, and auto-invest to help users grow their crypto holdings.

- Launchpad & Launchpool: Platforms that allow users to join early-stage token launches and earn new tokens by staking BNB or other cryptocurrencies.

- Binance P2P: A peer-to-peer marketplace where users can directly buy and sell crypto using local currencies and payment methods.

- Binance Pay: A borderless payment solution that lets users and merchants send, receive, and spend crypto instantly with zero fees.

- Binance Card: A crypto debit card that allows users to spend their digital assets globally, automatically converting crypto to fiat at the point of purchase.

- BNB Chain: Binance’s native blockchain network supporting decentralized applications (dApps), NFTs, and DeFi projects powered by BNB.

- Binance NFT Marketplace: A platform for minting, buying, and selling non-fungible tokens (NFTs) across multiple networks and collections.

- SAFU Fund (Secure Asset Fund for Users): An emergency insurance fund established to protect user assets and enhance overall platform security.

Which Cryptocurrencies Can You Trade on Binance?

Binance stands out for offering one of the largest selections of cryptocurrencies among global exchanges, with access to over 350 digital assets and hundreds of trading pairs. This wide range caters to both beginners exploring mainstream coins and advanced traders seeking niche opportunities. Here’s a breakdown of the main categories available:

- Major Cryptocurrencies – Trade top-tier coins like Bitcoin (BTC), Ethereum (ETH), and Binance Coin (BNB), which dominate liquidity and market volume.

- Altcoins – Explore innovative projects such as Solana (SOL), Cardano (ADA), Avalanche (AVAX), and Polkadot (DOT) for portfolio diversification.

- Stablecoins – Binance lists key stable assets like Tether (USDT), USD Coin (USDC), and First Digital USD (FDUSD), providing a safe haven during volatile markets.

- DeFi and Web3 Tokens – Engage with decentralized finance assets like Uniswap (UNI), Aave (AAVE), and Curve (CRV) to access blockchain-based financial tools.

- Innovation Zone Tokens – Discover early-stage, high-risk, high-reward projects that Binance lists under its Innovation Zone for experienced traders.

Recommanded Articles:

- Best Bitcoin Faucets

- Solana (SOL) Price Prediction

- Best Crypto Trading Bots

- Pionex Review

- Best Crypto Savings Accounts

Fees & Payment Methods

| Category | Typical Fee / Payment Methods | Notes & Details |

| Spot trading (maker/taker) | Standard rate: ~0.10% maker / 0.10% taker. | Fees apply when you buy or sell crypto in the spot market. Rates can be reduced based on 30-day volume and holding the native token (BNB). |

| Deposit (crypto) | Usually free for most cryptocurrencies. | You still pay the network (gas) fee on the sending side; Binance does not charge a deposit fee for most coins. |

| Withdrawal (crypto) | Flat fee varies by asset and network (e.g., for BTC, a small fixed fee) | This fee covers the blockchain network cost; it changes depending on network congestion. |

| Fiat deposit (card/bank transfer) | Varies by currency & region. For example: credit/debit card ~2% in some cases. | Payment methods include bank transfers, P2P, card payments depending on location. For India, INR deposit via P2P is common. |

| Fiat withdrawal | Varies by region & method; e.g., USD deposits via SWIFT in >70 countries with zero fee (as of Oct 2025) | Withdrawal times depend on bank/region. Some fiat withdrawal methods may carry bank or intermediary charges. |

| Payment / funding via P2P/fiat-on-ramp | P2P methods support many payment types (bank transfer, UPI, IMPS, etc) → fee often zero for the platform side, but you’ll incur your bank’s fees. | In India, for example, users deposit INR via P2P using UPI/IMPS. Always check sellers’ payment terms, rates, and trust metrics. |

| Discounts (native token usage / trading volume tiers) | If you hold and use BNB to pay fees, you can get discounts. | Upgrading your VIP level by trading higher volumes also reduces maker/taker fees. |

Binance Trading Experience

The trading experience on Binance is fast, intuitive, and designed to suit all types of users. Beginners can easily buy and sell cryptocurrencies through a simple interface, while advanced traders benefit from detailed charts, multiple order types, and real-time market data. The platform offers both web and mobile apps with smooth performance and customizable dashboards. Overall, Binance combines high liquidity, low fees, and advanced features to deliver a professional-grade trading experience with global accessibility.

Regulation & Compliance

Binance operates in one of the most tightly regulated sectors, making compliance a key priority. Over recent years, the exchange has taken major steps to strengthen its global regulatory standing by securing licenses and registrations in several countries, including France, Italy, and Dubai. Binance has also expanded its compliance team and implemented robust KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures to meet local requirements. Despite facing past scrutiny and restrictions in some regions, Binance continues to collaborate with regulators worldwide, demonstrating a growing commitment to transparency, user protection, and long-term industry trust.

Is Binance Credible and Trustworthy?

Yes, Binance is reasonably credible and trustworthy for many users, especially if you take basic safety precautions (use 2FA, secure your device, enable withdrawal address whitelists). However:

- Because of its regulatory history, it’s especially important to check your country’s local laws and Binance’s compliance there (licensing status, protections).

- Always assume higher risk than a fully-regulated traditional financial institution; keep critical assets in cold storage off the platform if long-term.

- Your trust in Binance should be conditional: trust its infrastructure and features, but use your own judgment about jurisdictional risks and transparency.

Customer Support

Binance offers 24/7 live chat and an extensive Help Center, but response times can vary depending on traffic. While most queries are resolved quickly, some users report delays for account-related issues. The multilingual support and community forums are valuable additions for international users.

Who Should Consider Using Binance?

Binance caters to a wide range of users — from beginners exploring crypto for the first time to seasoned traders seeking advanced tools and low fees. Understanding who benefits most from Binance helps readers decide if it’s the right exchange for their trading goals.

| User Type / Category | Why Binance Might Be a Good Fit | What to Keep in Mind / Caution |

| Beginner Traders | Easy access to spot trading, educational tools (Binance Academy), and intuitive mobile app. | The advanced interface can feel overwhelming at first; start with “Lite Mode.” |

| Active / Professional Traders | Advanced charting tools, low trading fees, deep liquidity, futures and margin options. | High complexity — requires understanding of advanced trading mechanics and risk. |

| Long-Term Investors (HODLers) | Offers staking, savings, and earn programs for passive income. | Must assess staking risks and lock-up terms; yields vary. |

| Institutional / High-Volume Traders | VIP fee tiers, API access, and professional trading infrastructure. | Requires high-volume verification and possible regulatory documentation. |

| Crypto Enthusiasts & DeFi Users | Wide crypto ecosystem — NFTs, Launchpad, Binance Pay, and cross-chain tools. | Some services restricted in certain countries; verify local access. |

| Users Seeking Low Fees | Among the lowest fees in the industry, plus 25% discount with BNB. | Fee structure can change; must monitor Binance announcements. |

| Mobile-First Traders | Comprehensive mobile app with real-time trading, alerts, and portfolio tracking. | Advanced features may be limited compared to the desktop version. |

| Global Users | Multilingual support, fiat gateways in many regions. | Regulatory restrictions apply in some countries (e.g., the U.S.). |

What Are the Best Alternatives to Binance?

1. Coinbase: Best for Beginners

Coinbase is one of the most beginner-friendly crypto exchanges, known for its simple interface and strong regulatory compliance. It’s perfect for users who value transparency and security over access to exotic altcoins.

Pros: Easy fiat deposits, highly regulated, educational tools.

Cons: Higher fees and fewer trading pairs than Binance.

Read: Coinbase Exchange Review

2. Kraken: Best for Security and Regulation

Kraken is a trusted U.S.-based exchange with an excellent track record for safety and reliability. It caters to both beginners and experienced traders, offering spot, futures, and staking options.

Pros: Outstanding security, transparent operations, low fees.

Cons: Interface slightly complex for new users.

3. KuCoin: Best for Altcoin Variety

KuCoin is a go-to platform for traders who want access to a vast selection of cryptocurrencies beyond the mainstream options. It provides robust trading tools and competitive fees.

Pros: 700+ altcoins, low fees, strong trading interface.

Cons: Limited regulatory oversight in some regions.

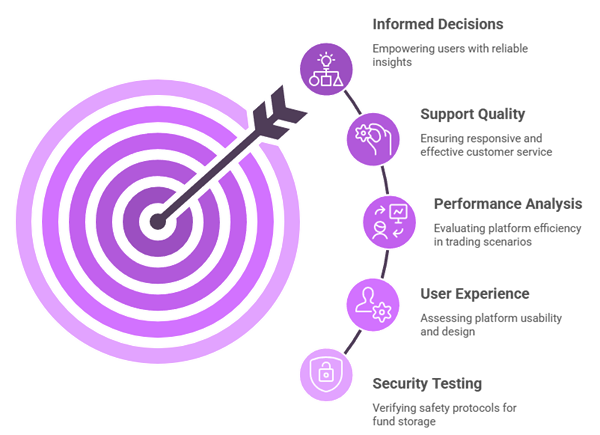

How Did We Conduct Our Binance Review?

Our Binance review was crafted through detailed research, expert testing, and user experience evaluation. We aimed to ensure reliability, accuracy, and transparency in every aspect of our analysis. The review process reflects insights from financial analysts and crypto experts to help you make informed decisions confidently.

- Research Depth: We chose based on comprehensive data from verified sources to ensure factual accuracy and unbiased conclusions for readers.

- Expert Evaluation: Our team made sure to shortlist tools through professional traders’ insights and verified crypto analysts’ market evaluations.

- Security Testing: We selected parameters that assess Binance’s safety protocols precisely, ensuring your funds are stored securely without compromise.

- User Experience: We evaluated how smoothly the platform operates, focusing on ultra-responsive design and hassle-free setup for all users.

- Performance Analysis: The experts in our team selected features based on consistency, reliability, and optimized efficiency during real-world trading scenarios.

- Support Quality: We made sure to consider customer feedback frequency and responsiveness, ensuring rapid and reliable solutions to resolve issues effectively.

Conclusions for Binance Crypto Exchange Review

I value platforms that balance innovation with security, and Binance demonstrates that balance effectively. Compared to others, few exchanges combine depth of features with global accessibility so seamlessly. Its strength lies in its technology, reliability, and commitment to evolving with regulations. Binance simplifies complex trading for everyday users, making digital finance more approachable. For anyone seeking both growth and confidence in crypto, Binance provides a strong, forward-moving foundation.

Binance FAQs

Who owns Binance?

Binance was founded in 2017 by Changpeng Zhao (CZ) and Yi He. CZ remains its main shareholder and public face. The company operates globally without a fixed headquarters, reflecting its decentralized business model and adaptability to international markets.

Why is Binance so popular?

Binance gained popularity for offering hundreds of cryptocurrencies, low trading fees, and advanced features like futures, staking, and P2P trading. Its user-friendly interface, high liquidity, and innovation have made it appealing to both beginners and professionals worldwide.

Is Binance legit in the USA?

In the U.S., Binance operates as a separate entity called Binance.US, registered with FinCEN as a Money Services Business. The global Binance platform isn’t fully licensed in the U.S. and faces ongoing regulatory scrutiny, but Binance.US complies with U.S. regulations for American users.

Can I deposit Indian Rupees (INR) directly on Binance?

Yes. Indian users can deposit INR through Binance’s P2P feature, which supports UPI and IMPS payments. It allows users to buy or sell crypto directly in INR, though availability depends on regulatory conditions. Always use verified merchants for safety.

Do I need to verify my identity before using Binance?

Yes. Binance requires Know Your Customer (KYC) verification to unlock features like fiat deposits, withdrawals, and higher limits. Verification helps prevent fraud and ensures compliance with global anti-money laundering (AML) laws.

Can I hold many different cryptocurrencies on Binance?

Yes. Binance supports hundreds of cryptocurrencies and thousands of trading pairs. Users can hold, trade, and manage a diverse portfolio easily from one account, making it ideal for those exploring multiple digital assets.

Is Binance considered a secure platform for trading crypto?

Yes. Binance uses two-factor authentication (2FA), cold wallet storage, and a Secure Asset Fund for Users (SAFU) to protect funds. Although no exchange is risk-free, its multi-layered security measures make it one of the most trusted platforms.

Is Binance available and fully functional in every country without restrictions?

No. Binance’s availability varies by region due to local regulations. Some countries restrict or ban its services, while others limit features like derivatives trading. Users should check Binance’s regional compliance before registering.

Do I need to move my funds off Binance into a personal wallet for safety?

Yes. For long-term storage, it’s safer to move funds into a personal wallet where you control the private keys. While Binance is secure, self-custody reduces dependency on any exchange and protects against hacks or regulatory issues.