Crypto Lending Platforms Comparison

Choosing the best crypto lending platforms isn’t about chasing the highest advertised yield; it’s about balancing real counterparty risk, liquidity, and operational transparency you can measure in stress scenarios. In live markets I’ve seen blue-chip platforms fail to honor redemptions when volatility spiked, while resilient ones maintained orderly withdrawals and fair pricing. Traders and investors must evaluate things like smart contract audits, loan-to-value behavior in drawdowns, collateral governance, and stability of liquidity pools under stress. After reading, you’ll better judge which protocols adjust rates appropriately, avoid hidden liquidation traps, and protect principal when assets gyrate sharply with disciplined risk frameworks.

Top Recommendations at a Glance:

- Best for Decentralization: Aave

- Best for Versatility: Nexo

- Best for Yield Efficiency (DeFi): Morpho

What Are Crypto Lending Platforms?

Crypto Lending Platforms are digital services that allow users to lend or borrow cryptocurrencies, typically by locking assets as collateral to secure loans.

These platforms generally operate through automated systems that match lenders seeking yield with borrowers seeking liquidity. Loans are usually issued in cryptoassets or stable-value tokens, with terms enforced by smart contracts or platform rules.

How crypto lending typically works

- Borrowers deposit cryptocurrency as collateral, often exceeding the loan value to manage risk.

- Lenders supply assets to a pooled liquidity system and earn interest over time.

- Loan terms, interest rates, and liquidation thresholds are generally predefined and algorithmically enforced.

Key participants and components

- Borrowers: users seeking short-term liquidity without selling assets.

- Lenders: users providing capital in exchange for interest.

- Collateral management: systems that monitor loan-to-value ratios and trigger liquidations if thresholds are breached.

- Smart contracts or custodial controls: mechanisms that automate or administer loans and repayments.

Core purpose

- To provide access to liquidity while allowing users to retain exposure to their crypto holdings, or to earn yield on idle assets.

Main types of crypto lending platforms

1) Centralized Crypto Lending Platforms (CeFi): Centralized Crypto Lending Platforms (CeFi) are custodial services where a centralized company manages user funds and facilitates crypto lending and borrowing. Users deposit crypto, earn interest, or borrow assets, while the platform controls custody, credit risk assessment, interest rates, and liquidation. CeFi offers ease of use, higher liquidity, and customer support but introduces counterparty risk, regulatory exposure, and reduced transparency compared to decentralized alternatives.

CeFi Examples:

- BlockFi – Centralized crypto lending and interest accounts.

- Celsius Network – Custodial lending and borrowing platform.

- Nexo – Centralized crypto-backed loans and yield services.

2) Decentralized Crypto Lending Platforms (DeFi): Decentralized Crypto Lending Platforms (DeFi) are non-custodial, blockchain-based protocols that enable peer-to-protocol crypto lending and borrowing via smart contracts. Users retain control of assets, interact trustlessly without intermediaries, and access transparent, algorithmic interest rates and liquidations. DeFi reduces counterparty risk but introduces smart contract risk, over-collateralization requirements, and reliance on on-chain liquidity and oracles.

DeFi Examples:

- Aave – Decentralized, non-custodial lending protocol on Ethereum and other chains.

- Compound – Algorithmic, smart contract–based crypto lending platform.

- MakerDAO – DeFi protocol enabling crypto-backed borrowing via DAI stablecoin.

Common use example

A user holding cryptocurrency may deposit it as collateral to borrow a stable-value token for short-term expenses, while planning to repay the loan later to reclaim the original asset.

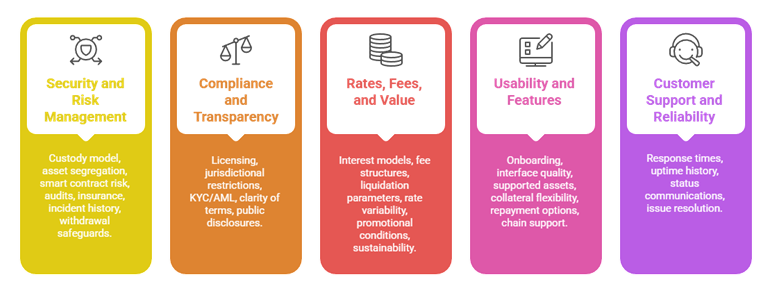

Our Methodology to Review Key Factors to Consider When Choosing a Crypto Lending Platform

Our methodology is designed to deliver accurate, experience-based, and trustworthy evaluations of crypto lending platforms. We combine hands-on testing with expert analysis to assess real-world performance, risk exposure, and user outcomes across both lending and borrowing use cases.

Key evaluation criteria

- Security and risk management: custody model, asset segregation, smart contract or counterparty risk, audits, bug bounties, insurance or coverage claims (including exclusions), incident history, and withdrawal safeguards

- Compliance and transparency: stated licensing or registration, jurisdictional restrictions, KYC/AML practices, clarity of terms, and public disclosures

- Rates, fees, and value: interest and yield models, fee structures, liquidation parameters, rate variability, promotional conditions, and long-term sustainability

- Usability and features: onboarding, interface quality, supported assets, collateral flexibility, repayment or redemption options, and chain support

- Customer support and reliability: response times, uptime history, status communications, and issue resolution processes

Testing and verification

We review primary documentation and perform controlled user journeys, including depositing assets, collateralizing, borrowing or earning, repaying or redeeming, and withdrawing funds. Offerings are compared against industry peers, with community feedback analyzed for consistent patterns rather than isolated claims.

Best Crypto Lending Platforms (Top Picks)

- AAVE: Best for decentralized liquidity and flash loans

- Binance Loans: Best for integrated exchange liquidity and flexibility

- Nexo: Best for high-yield savings and credit lines

- Morpho: Best for peer-to-peer interest rate optimization

- CoinRabbit: Best for instant loans without credit checks

- Compound: Best for autonomous, algorithmic interest rate markets

- Unchained Capital: Best for secure multisig collaborative bitcoin custody

- Salt Lending: Best for protecting collateral during market downturns

Which are the Most Trusted Crypto Loan Platforms?

1) AAVE

AAVE is a decentralized liquidity protocol that allows users to lend and borrow digital assets through a secure, blockchain-based framework. It is widely regarded as a reliable platform because it prioritizes transparency and risk control, which has strengthened its reputation across the DeFi community. Its long-standing presence in the market reflects consistent trust from both developers and retail users.

The protocol is also known for its strong security philosophy, supported by audits and continuous monitoring. I have followed AAVE for years and seen its commitment to responsible innovation. It suits beginners who want a simple entry to decentralized finance and also benefits experienced traders who value autonomy and control. This makes it a suitable tool for diverse user needs without overwhelming complexity.

Features:

- Liquidity markets: Users access segmented pools for structured lending operations.

- Interest model: Algorithm adjusts borrow rates using real-time supply data.

- Collateral options: Wide asset range expands flexible borrowing opportunities.

- Governance system: Token holders guide protocol upgrades through proposals.

- Flash loans: Instant, collateral-free loans enable advanced, automated strategies.

- Risk engine: Dynamic parameters manage exposure across all supported assets.

- Market isolation: New tokens launch with controlled borrowing environments.

- Layer-2 support: Scalable networks reduce fees for frequent participants.

- Pool transparency: On-chain data provides clear visibility of market conditions.

Pros:

- Interface feels simple for daily lending activity.

- Withdrawals process quickly without confusion.

- I appreciate the strong transparency across markets.

- Fees stay predictable during normal market hours.

Cons:

- I notice occasional delays during heavy network traffic.

- Borrow limits change fast during volatility.

- Some users report difficulty selecting proper collateral

Visit: https://aave.com/

2) Binance Loans

Binance Loans is a lending service within the broader Binance ecosystem, designed to help users unlock liquidity without selling their crypto assets. It has grown in popularity due to Binance’s strong operational track record and its commitment to transparent risk controls.

The platform maintains a clear focus on user protection, with practices that reinforce responsible borrowing and disciplined collateral management. Its reputation in the market is shaped by high uptime, consistent performance, and solid backing from one of the world’s most recognised crypto exchanges.

I see it fitting well for users who want access to structured borrowing without dealing with traditional finance hurdles. Newer traders also appreciate its easy entry path, while experienced market participants value its predictable execution. Overall, it serves users who want dependable crypto-backed lending supported by an established platform.

Features:

- Collateral Options: Broad asset support enabling flexible crypto-backed borrowing choices.

- Loan Terms: Adjustable durations that support tailored user repayment planning.

- Borrow Limits: Dynamic limits updated based on real-time market liquidity data.

- Interest Structure: Transparent calculations offering predictable borrowing cost visibility.

- Margin Buffer: Automated protections reducing forced liquidation risks during volatility.

- Multi-Asset Support: Borrowers access various tokens for strategic trading needs.

- Redemption Flow: Smooth collateral release after timely repayment verification.

- Price Monitoring: Constant collateral tracking enabling stable loan management decisions.

- Notification System: Timely alerts delivered for repayment or collateral adjustments.

- Loan Renewal: Streamlined rollover option for users needing extended access.

Pros:

- I find borrowing steps simple for new users.

- Interest charges stay predictable across most terms.

- Liquidity remains strong during market swings.

- Dashboard layout keeps planning clear for borrowers.

Cons:

- Liquidation events feel stressful for some newcomers.

- We find loan renewals slightly confusing at first.

Visit: https://www.binance.com/en/loan

3) Nexo

Nexo is a well-established crypto lending platform known for its strong operational discipline and transparent business structure. It maintains a security-first philosophy supported by reputable custodial partners and continuous risk monitoring. The platform has earned a solid market reputation for consistency, regulatory alignment, and steady user growth.

Newer investors value its guided environment, while experienced users appreciate its streamlined borrowing options and broad asset support. I find its focus on predictable user outcomes reassuring. It works best for individuals who want simple lending access without navigating complex DeFi mechanics. The platform also suits users seeking dependable liquidity solutions while keeping custodial management straightforward. In my view, its long-term stability adds meaningful confidence.

Features:

- Interest Accounts: Daily compounding returns with flexible withdrawal options anytime

- Borrowing Access: Instant credit lines backed by supported digital asset collateral

- Asset Coverage: Wide crypto selection with expanding global support framework

- Custodial Security: Multi-layer protection managed through institutional grade partners

- Real-Time Audits: Continuous proof-of-reserves verification for transparent asset backing

- Exchange Integration: Seamless swaps between supported assets inside one dashboard

- Fiat Support: Fast bank transfers enabling smooth deposits and withdrawals globally

- Reward Program: Tiered loyalty system enhancing yields and borrowing terms

- Automated Tools: Streamlined interest calculations for easy planning and monitoring

- Account Monitoring: Live notifications for collateral movements and market shifts

Pros:

- Nexo offers very fast withdrawals for most users.

- Support responds quickly during peak trading periods.

- I like the smooth loan processing experience here.

- We appreciate stable interest payouts over time.

- User guidance feels clear for beginners.

- Mobile navigation feels simple for daily tasks.

Cons:

- Some assets show slower processing during volatility.

- I notice limited features in certain regions.

- We find fee clarity confusing at peak times.

- Customer verification delays occur for new users

Visit: https://nexo.com/

4) Morpho

Morpho is a decentralized lending protocol on Ethereum and Base that connects lenders and borrowers through a modular, on‑chain credit network. It focuses on overcollateralized loans, so borrowers must lock in more collateral value than they take out, which helps protect lenders from defaults and sudden market swings.

The protocol runs as immutable smart contracts, supported by multiple third‑party audits, formal verification, and continuous monitoring, which together signal a strong security‑first philosophy. Morpho’s architecture is designed as a base layer that other DeFi apps and institutions can plug into, which is why it has attracted significant liquidity and integration interest across Ethereum’s ecosystem.

From a veteran trader’s lens, this makes it suitable for users who want deeper control over lending markets without leaving the safety of overcollateralized, transparent on‑chain rails. It suits DeFi‑curious retail lenders, more advanced yield seekers, and even sophisticated desks that care about predictable risk management in crypto credit markets.

Features:

- Overcollateralized lending markets: Borrowers post higher collateral than borrowed amount.

- Modular architecture: Separate components handle markets, risk, and vault strategies.

- Peer‑to‑peer matching layer: Directly connects lenders and borrowers for rate optimization.

- Liquidity pool fallback: Routes unused liquidity into integrated protocols like Aave, Compound.

- Isolated markets: Each market has independent risk parameters and collateral settings.

- Morpho Vaults: Curated strategies allocate deposits across multiple markets automatically.

- Multi‑chain support: Operates across Ethereum and Base for broader market access.

- Protocol code designed to run without upgradeability switches.Immutable core contracts:

- Extensive security audits: Multiple external reviews and formal verification of key components.

- Transparent on‑chain metrics: TVL, volumes, and market health visible via dashboards and explorers.

Visit: https://app.morpho.org/ethereum/borrow

5) CoinRabbit

CoinRabbit operates as a non-custodial crypto lending service launched in 2019. The platform enables users to borrow stablecoins against their cryptocurrency collateral. It supports over 30 different cryptocurrencies as collateral options. The platform emphasizes user privacy and security through its operational model.

No credit checks or lengthy verification processes are required. I have observed that CoinRabbit maintains transparent loan-to-value ratios consistently. The service targets crypto holders who need temporary liquidity urgently. Borrowers retain ownership of their assets throughout the loan period. CoinRabbit processes loan requests within minutes, not days or weeks.

The platform operates with established security protocols and insurance coverage. Users benefit from automated systems that reduce human error risks. The company maintains a straightforward fee structure without hidden charges. I find their customer support responsive across multiple communication channels.

Features:

- Instant Loans: Automated loan approvals deliver fast access without delays.

- Flexible Collateral: Users deposit various crypto assets for smooth loan creation.

- No KYC Option: Certain loans open with minimal personal verification needed.

- Stable APR: Borrowers receive predictable rates that remain stable during terms.

- Continuous Access: Loan management dashboard stays available across all supported devices.

- High LTV Range: Borrowers can access generous value proportions against collateral.

- Asset Continuity: Collateral remains untouched during market moves unless liquidation triggers.

- Transparent Calculations: Loan metrics appear clearly before users confirm terms.

- Quick Withdrawals: Funds move rapidly to selected wallet destinations.

- Collateral Monitoring: Automated alerts notify users when positions approach risk thresholds.

Pros:

- Loan processing completes in under 10 minutes consistently.

- I appreciate the absence of mandatory identity verification steps.

- Interest rates remain competitive compared to traditional lending platforms.

- The platform accepts less common altcoins as valid collateral.

Cons:

- The platform charges higher rates compared to decentralized lending protocols.

- The margin call threshold triggers earlier than some competitors.

Visit: https://coinrabbit.io/

6) Compound

Compound is a decentralized lending protocol built on Ethereum that allows users to supply and borrow digital assets through automated smart contracts. It maintains a strong reputation for transparency because every action occurs on chain and can be independently verified. The project has emphasized security through regular audits and a cautious governance structure that aligns with long term sustainability.

Many users view it as a dependable system due to its consistent operational record and clear risk parameters. I appreciate how its open design has helped broaden access to global lending markets. It is particularly suitable for users who want predictable lending outcomes without depending on a traditional intermediary. Beginners, passive yield seekers, and experienced DeFi participants often find its approach stable and straightforward.

Features:

- Smart contract automation: Protocol executes lending rules without manual intervention.

- Governance token model: Community members propose and vote on protocol changes.

- Transparent accounting: All lending activity remains visible through public blockchain data.

- Algorithmic interest rates: Borrowing and lending costs adjust dynamically with demand.

- Multi asset support: Users interact with several leading Ethereum based tokens.

- Open source codebase: Developers audit and expand protocol logic freely.

- Collateralized borrowing: Borrowers secure loans using supported digital assets.

- cToken representation: Deposits convert into interest bearing blockchain assets.

- Continuous accrual: Interest accumulates block by block for lenders.

- Integration ecosystem: Many DeFi applications connect directly with Compound markets.

Pros:

- Users like its clear process for predictable lending returns.

- I find the interface simple for new DeFi participants.

- The protocol offers steady performance during volatile markets.

- It supports broad access for many global users.

Cons:

- I see liquidation risks when markets move fast.

- Rates can shift quickly based on market activity.

Visit: https://compound.finance/

7) Unchained Capital

Unchained Capital is a Bitcoin-native financial services company specializing in Bitcoin-backed loans and secure custody solutions. It is known for its robust security philosophy, focusing on multisignature vaults and collaborative custody to ensure client assets are protected.

The platform is best suited for long-term Bitcoin holders who want to borrow against their holdings while maintaining control and security. As a user, I appreciate the clear communication and support Unchained Capital provides during the onboarding process, which helps new clients feel confident in managing their Bitcoin securely.

Features:

- Security: Two-factor authentication and multisignature vaults for maximum protection.

- Collaborative Custody: Borrower, Unchained, and third-party each hold a key.

- Bitcoin-Native: Exclusively focused on Bitcoin lending and custody.

- IRA Loans: Specialized loans for funding retirement accounts.

- Non-Custodial Access: Clients retain control over their keys and assets.

- Business Loans: Dedicated products for mining companies and businesses.

- Fast Funding: Loan proceeds can be available in as little as 24 hours.

- Estate Planning: Tools to help with Bitcoin inheritance and recovery.

Pros:

- The platform prioritizes Bitcoin self-custody principles effectively.

- Loan structures feel conservative and risk-aware for beginners.

- Customer support responses are detailed and knowledgeable.

- Reputation remains strong among long-term Bitcoin holders.

Cons:

- Interest rates may feel higher than aggressive competitors.

- Limited asset support restricts diversification options.

Visit: https://www.unchained.com/

8) Salt Lending

Salt Lending is a crypto-backed lending platform that lets users borrow funds while holding their digital assets as collateral. Founded in 2016, it built its reputation around regulated lending practices and a conservative risk framework that appeals to cautious investors. The platform emphasizes stability, transparency, and responsible lending models that align with evolving market standards.

Its long operational history gives it credibility among borrowers who prefer established providers. Salt Lending focuses on secure custody partnerships and controlled processes that support user trust. I find its approach reassuring for borrowers who value strict risk management. It suits beginners seeking simple access to crypto-backed loans and seasoned traders who want liquidity without exiting long positions.

Features:

- Collateral Management: Automated collateral monitoring maintains required thresholds during volatile markets

- Loan Customization: Adjustable loan terms support varied liquidity and repayment preferences

- Interest Structure: Transparent interest model helps users estimate repayment costs easily

- Security Controls: Institutional custody partners safeguard crypto assets during loan periods

- Compliance Oversight: Regulated lending framework aligns with financial industry expectations

- Account Dashboard: Clean interface simplifies loan tracking and collateral visibility

- Loan Execution: Fast approval system speeds access to borrowed capital

- Withdrawal Process: Smooth fund distribution shortens wait times for loan disbursements

- Borrowing Tools: Integrated calculators help estimate loan scenarios before committing

Pros:

- Salt processes loans quickly for most users.

- We value its strong reputation among cautious borrowers.

- Platform navigation feels simple.

- Rates remain stable for many loan profiles.

Cons:

- I find asset limits restrictive for some strategies.

- Terms lack flexibility for certain advanced borrowers.

Visit: https://saltlending.com/

Top Crypto Lending Platforms Comparison

| Feature | AAVE | Binance Loans | Nexo | Morpho |

| Best For | DeFi users & advanced traders | CeFi users within Binance ecosystem | Easy crypto borrowing & lending with rewards | Optimized DeFi lending yields & borrowing |

| Pricing (Interest / Fees) | Variable based on market | Competitive, asset-dependent (collateralized) | Competitive, flexible & loyalty tiers | Variable real-time market rates via matching engine |

| CeFi / DeFi | DeFi | CeFi | CeFi | DeFi |

| Supported Assets | Wide range across multiple blockchains | Large range of cryptos (BTC, ETH, stablecoins, etc.) | 100+ assets | Depends on underlying DeFi pools (ETH, USDC, DAI, etc.) |

| APY Range | Variable by pool and market conditions | Variable, generally competitive | CeFi yield / borrowing rates vary with loyalty | DeFi real-time optimized yields |

| LTV Ratio | Protocol-dependent collateral ratios | Asset dependent, overcollateralized | Up to specific % per asset (flexible max LTV) | Matches DeFi pool risk parameters |

| Custody Type | Non-custodial (user wallet control) | Custodial (platform holds assets) | Custodial | Non-custodial (smart contract) |

Risks of Using Crypto Lending Platforms

Crypto lending platforms can offer attractive returns, but they also come with clear risks that every beginner should understand. These risks are not always obvious at first glance, especially in a fast-moving crypto market. I have seen many users focus only on interest rates and ignore what could go wrong. That can lead to losses that are hard to recover from. From my experience, understanding these risks is just as important as chasing higher yields.

Below are the key risks to consider when reviewing the best crypto lending platforms:

- Platform insolvency: If a platform mismanages funds or faces heavy withdrawals, it may freeze accounts or shut down.

- Lack of regulation: Many platforms operate without strong legal oversight, so user protection is limited.

- Smart contract failures: Bugs or exploits can drain funds without warning.

- Market volatility: Sharp price drops can trigger liquidations, even if you did nothing wrong.

- Counterparty risk: Borrowers may fail to repay loans during market stress.

How to Minimize Risk When Lending Crypto

Lending crypto can be rewarding, but managing risk should always come first. Many losses happen not because of bad luck, but due to poor planning and overconfidence. When done carefully, crypto lending can be safer and more predictable, even for beginners. I always focus on protection before returns.

Here are practical ways to minimize risk when lending crypto:

- Choose reputable platforms: Use platforms with a strong track record, clear terms, and transparent operations.

- Diversify your funds: Never lend all your crypto on one platform or to one borrower.

- Prefer overcollateralized loans: These reduce losses if the borrower defaults.

- Start with stablecoins: They help limit the impact of market volatility.

- Understand liquidation rules: Know how and when collateral is sold during price drops.

- Avoid chasing high yields: Extremely high interest often signals higher risk.

Crypto Lending vs Staking vs Yield Farming

| Feature | Crypto Lending | Staking | Yield Farming |

| Definition | Lending crypto to borrowers in exchange for interest | Locking crypto to help secure a blockchain network | Providing liquidity to DeFi protocols to earn rewards |

| Primary Purpose | Earn interest on idle assets | Support network security & validation | Maximize returns through liquidity provision |

| How Returns Are Earned | Fixed or variable interest paid by borrowers | Block rewards + transaction fees | Trading fees, token incentives, rewards |

| Typical APY | Low–Medium (3%–15%) | Low–Medium (4%–20%) | Medium–High (10%–100%+, highly variable) |

| Risk Level | Low–Medium | Low–Medium | Medium–High |

| Main Risks | Platform default, smart contract risk | Slashing, price volatility, lock-up periods | Impermanent loss, smart contract risk, volatility |

| Complexity | Beginner-friendly | Beginner to Intermediate | Intermediate to Advanced |

| Liquidity | Often flexible, some lock-ups | Usually locked for a period | Can usually withdraw anytime (fees may apply) |

| Capital Requirement | Any supported crypto | Specific staking tokens (e.g., ETH, SOL) | Token pairs or multiple assets |

| Best For | Passive income seekers | Long-term holders | Active users seeking higher yields |

| Examples | Aave, Compound, Nexo | Ethereum staking, Cardano staking | Uniswap, Curve, PancakeSwap |

Final Verdict: Are Crypto Lending Platforms Worth It?

Crypto lending platforms can be worth it for beginners seeking passive income, provided they understand the risks. Lending is simpler than trading or yield farming and offers relatively predictable returns, especially with stablecoins. However, it is not risk-free—platform failures, hacks, and custody risks are real, so starting small and choosing reputable platforms is essential.

For advanced users, crypto lending works best as a portfolio component rather than a core strategy. When used alongside diversification, risk management, and careful platform selection, lending can provide steady, risk-adjusted returns without chasing high volatility yields.

Frequently Asked Questions (FAQ)

Is crypto lending safe?

Crypto lending safety depends on platform security, transparency, and risk management. Centralized platforms carry custodial and insolvency risks, while DeFi platforms rely on smart contract security. Market volatility and hacks remain key risks. Using reputable platforms and diversifying assets improves overall safety.

Can I lose my crypto when lending?

Yes, crypto lending involves real loss risk. Funds can be lost due to platform failure, smart contract exploits, liquidation events, or extreme market volatility. Most platforms do not offer insurance or guarantees. Users should assess risk carefully before lending assets.

How do crypto lending platforms make money?

Crypto lending platforms earn by charging borrowers higher interest rates than paid to lenders. Additional revenue comes from loan origination fees, liquidation penalties, spreads, and token incentives. DeFi platforms automate this via smart contracts, while CeFi platforms manage funds centrally.

CeFi vs DeFi: which is better?

CeFi is easier for beginners, offering simple interfaces and customer support but requiring trust in custodians. DeFi offers greater transparency, control, and often higher yields but demands technical knowledge. The better option depends on user experience, security preference, and risk tolerance.

Which crypto lending platforms are best for beginners?

Beginner-friendly crypto lending platforms include AAVE, Binance Loans, and Nexo. These CeFi platforms provide simple onboarding, custodial management, and predictable yields. However, users must trust the platform with funds and should start with small amounts.