Every trade, token, and transaction tells a story—only the right tracker helps you read it clearly. The best crypto portfolio trackers combine intuitive dashboards with real-time data and deep analytics to support smart investment strategies. Explore the best crypto portfolio trackers, helping you stay on top of your digital assets with ease. I created this content to guide traders, analysts, and serious enthusiasts toward tools that value precision, security, and usability. Look out for trends like multi-wallet syncing and AI-driven forecasting.

After spending over 124 hours testing 25+ crypto portfolio tools, I have handpicked the Best Crypto Portfolio Tracker Apps for traders who demand transparency, accuracy, and reliability. This well-researched comparison offers a credible look into features and pros and cons. I once relied on a tracker that delayed syncing and lost crucial trade data, which taught me the value of real-time, verified tools.

Why Do You Need a Crypto Portfolio Tracker App?

Crypto never sleeps. Prices swing in seconds and wallets spread across exchanges, cold storage, and DeFi protocols. A tracker app brings every holding into one clean dashboard and shows live values without manual copy-paste. I rely on one tool to spot sudden drawdowns and rebalance before losses snowball. New-age trackers now read 70+ blockchains, pull NFT floor prices, and even flag staking rewards as they land. They generate country-specific tax reports that match 2025 rules, so my accountant stays happy. Most importantly, they add AI risk scores that warn when a token’s liquidity dries up. With regulation tightening and hacks still common, a trustworthy tracker is no longer a nice extra. It is the control tower for anyone serious about crypto growth and safety.

- Real-time overview: Watch every coin and chain on one screen.

- Multi-chain coverage: Sync wallets from Bitcoin to Solana to Layer-2s.

- Tax readiness: Export compliant reports in one click.

- Risk alerts: Get instant pings on sharp moves or contract exploits.

- AI insights: See predictive scores for volatility and on-chain health.

List of Best Crypto Portfolio Trackers: Recommended

After reviewing dozens of platforms, I have shortlisted my favorite crypto portfolio trackers based on accuracy, integrations, and user experience.

Here is a quick list of my top picks, along with the best use case for each tool:

- Koinly: Best for hassle-free tax reporting and portfolio tracking

- CoinTracking: Best for advanced analytics and historical trade analysis

- Kubera: Best for tracking crypto alongside stocks and traditional assets

- CoinLedger: Best for tax automation and user-friendly transaction import

- Kraken: Best for integrated exchange portfolio tracking

- CoinStats: Best for multi-exchange, multi-chain portfolio management

- Awaken: Best for real-time alerts and DeFi portfolio tracking

Top Crypto Portfolio Tracker Apps Review

Stay on top of your investments with apps that offer real-time tracking, intuitive dashboards, multi-exchange support, and seamless portfolio management across devices.

1) Koinly

Best for hassle-free tax reporting and portfolio tracking

Koinly is a comprehensive and intuitive crypto portfolio tracker that I have reviewed closely and personally recommend for anyone managing digital assets. I tested its dashboard and found it to be a great way to keep your holdings organized, especially with its real-time syncing across wallets and exchanges. During my analysis, I could access my entire portfolio instantly, which made it easy to monitor gains, losses, and generate accurate tax reports. I particularly appreciate the customization options for charts and reports—it is important to have features like these to enhance clarity and transparency. For anyone starting out, it is a good idea to choose a tool that helps you stay informed, and Koinly’s comprehensive tax summaries and easy-to-understand interface make it a top-rated choice.

Top Features of Koinly:

- ROI and Invested Fiat Tracking: This feature clearly shows how much fiat you have invested versus the actual return on investment across your portfolio. It helps you stay grounded by showing what is earned, not just the market value. I suggest reviewing this weekly to monitor performance trends and to realign your strategy before the market shifts.

- Profit/Loss Insights: You can easily assess realized and unrealized gains or losses in real time. This lets you spot underperformers quickly and act accordingly. I have personally used this during tax season, and it simplified my capital gains reporting significantly.

- NFT Dashboard: Koinly gives your NFT collection its own dashboard, keeping it separate from regular crypto assets. It tracks NFT buys, sells, and holdings in a clean, easy-to-read layout. The tool lets you filter by blockchain, which helped me organize Ethereum and Solana NFTs when my collection grew.

- Smart Transfer Matching: Koinly uses AI to detect internal transfers between your wallets, which reduces errors in cost-basis calculations. It prevents duplicate entries and ensures you are not taxed twice on the same coins. I tested this by moving ETH between two of my wallets, and it flagged and reconciled the transaction perfectly without needing any manual input.

- Import Integrations: Koinly allows you to automatically import transactions from over 900 exchanges, wallets, and blockchains using API or CSV. This eliminates manual data entry and centralizes all your crypto activities in one place. While using this feature one thing I noticed is that syncing via API saves hours compared to uploading CSVs manually—especially if you trade frequently across platforms.

- Broad Asset Support: Whether you are staking, yield farming, lending, or mining, Koinly handles it all in one platform. It even covers forks, margin trades, and DeFi tokens seamlessly. I recommend checking the asset support list before trying a new platform—Koinly usually has it covered, but a quick check can save cleanup later.

Pros:

- I could sync wallets seamlessly across 700+ exchanges and chains

- Provided me a real-time tax preview with every transaction logged

- Clean dashboard made my crypto gains and losses easy to read

- Powerful tagging options helped me categorize every airdrop properly

Cons:

- It allowed me to import but failed on some APIs

- Tax reports get expensive fast with more than basic usage

Pricing:

Koinly offers paid plans per tax year as follows: the Newbie plan at $49 for up to 100 transactions, the Hodler plan at $99 for up to 1,000 transactions, and the Trader plan at $179 for up to 3,000 transactions. A free trial is also offered for prospective users.

Try Koinly: https://koinly.io/crypto-portfolio-tracker/

2) CoinTracking

Best for advanced analytics and historical trade analysis

CoinTracking has become a reliable companion for me as I evaluated crypto wallets. I have found that it allows you to see your holdings in one place and helps you understand trends with powerful charts and reports. It is important to pay attention to the way it updates values in real time. In my experience, this may help beginners avoid guesswork in tracking gains. For example, it is one of the easiest and most effective ways to manage multiple coins confidently. Businesses managing client portfolios appreciate how CoinTracking simplifies tax reporting and profit analysis.

Top Features of CoinTracking:

- Portfolio Tracking Dashboard: This dashboard brings all your crypto activity into one place, including coins, NFTs, and DeFi assets. You get a real-time overview that is especially helpful when managing assets across several platforms. You will notice the interface gives you color-coded insights, which makes trend-spotting and performance evaluation much easier over time.

- 300+ Import Integrations: CoinTracking connects with over 300 platforms through CSV files, APIs, and even drag-and-drop functionality. I found this especially smooth when importing trades from Binance and MetaMask. While using this feature one thing I noticed is that mapping each field correctly during CSV import saves time and prevents sync errors later.

- Support for Coins, NFTs, DeFi: CoinTracking supports more than just Bitcoin and Ethereum. It also handles NFTs, staking rewards, liquidity pools, and other DeFi assets in one centralized location. This makes it ideal for users who diversify into newer Web3 categories.

- Tax Calculator & Reporting: The built-in tax calculator is incredibly detailed and compliant with global regulations. It manages everything from capital gains to donated or lost assets. I suggest verifying your income categories before submission—incorrect labeling can affect your final tax liability.

- Multiple Tax Methods: CoinTracking supports 13 tax strategies including FIFO, LIFO, AVCO, and country-specific methods like HMRC. This flexibility is a major plus if you are trading in multiple jurisdictions. I have used this to test scenarios for capital gains optimization, and it helped reduce my tax bill significantly.

- Auto‑Sync & API Access: The tool lets you auto-sync data via API, which means your dashboard stays current without manual updates. I set up auto-sync for Coinbase and Kraken, and it worked flawlessly. There is also an option that lets you schedule syncs during low-traffic hours to avoid API rate limits and lag.

Pros:

- I could import data from hundreds of exchanges seamlessly

- It helped me analyze realized and unrealized gains accurately

- I benefitted from rich charts visualizing portfolio trends

- It offered me portfolio tracking across NFTs and DeFi modes

Cons:

- I found pricing plans sometimes confusing for accurate selection

Pricing:

CoinTracking offers a free plan with support for up to 200 transactions, along with a 7-day unlimited trial. Paid plans include the Starter plan at $49/year for up to 200 transactions, the Pro plan at $159/year for up to 3,500 transactions, and the Expert plan at $239/year for over 20,000 transactions.

Try CoinTracking: https://cointracking.info/

3) Kubera

Best for tracking crypto alongside stocks and traditional assets

Kubera is the most impressive platform I have checked for managing a modern investment portfolio. Not only does it help you track all your assets—from crypto and stocks to real estate and collectibles—it also offers deep customization and AI insights to enhance decision-making. I could access my net worth and portfolio breakdown in real-time, and the support for multiple currencies was particularly helpful to me. While reviewing Kubera, I found that it is a top pick among those who want to avoid spreadsheets and manual calculations. Financial advisors often use Kubera to provide clients with accurate reports, scenario analysis, and secure document sharing, resulting in better service and client retention. If you want an engaging, high-quality tool for portfolio management, Kubera is an excellent option.

Top Features of Kubera:

- Unified Asset Tracking: This feature gives you a single view of your entire financial life by syncing crypto, stocks, real estate, cars, and more. I have used it to consolidate hard-to-track assets like domain names and gold holdings. While using this feature one thing I noticed is that adding non-digital assets manually allows you to include anything from collectibles to private equity.

- Crypto + Fiat Integration: Kubera makes it easy to view your crypto and fiat balances side by side, giving you real-time insight into your total net worth. I liked how I could track my Ethereum holdings next to my U.S. savings account. There is also an option that lets you label accounts for better clarity across asset types.

- Global Bank & Brokerage Connectivity: With access to over 10,000 financial institutions, Kubera pulls data from traditional banks and brokers automatically. I connected both my Chase and Fidelity accounts within minutes. I recommend setting account refresh intervals to “frequent” if you are tracking high-volume transactions.

- Wide Crypto Connectivity: Kubera supports top exchanges and wallets like Binance, Kraken, Metamask, Ledger, and more. When I tested it with my Trezor, it synced without any manual CSV uploads. The tool lets you label individual wallets, which really helps when managing multiple crypto projects.

- Automated Multi‑Currency Conversion: This function calculates your net worth accurately even if your assets are in multiple currencies. I had accounts in INR, EUR, and USD—it converted them into my base currency instantly. I suggest checking the exchange rate settings to ensure you are using live data and not delayed pricing.

- Recap Performance Analytics: The Recap screen became my go-to for reviewing gains and allocation trends over time. I relied on the quarterly report during tax planning and saw exactly how my holdings had shifted. You will notice that the breakdown by asset type and time period makes it easier to identify underperforming areas quickly.

Pros:

- It allowed me to track all assets in one view

- I could access global assets, even DeFi and traditional

- Real-time net worth updates helped me stay investment-aware

- Provided me automated syncing with banks, exchanges, and wallets

Cons:

- Minimal tax reporting tools for my diverse crypto holdings

Pricing:

Kubera offers two subscription plans: Kubera Essentials at $249 per year and Kubera Black at $2,499 per year, both of which come with a 14-day free trial.

Try Kubera: https://www.kubera.com/

4) CoinLedger

Best for tax automation and user-friendly transaction import

CoinLedger is an intuitive crypto portfolio tracker that allows you to import your activity from exchanges, wallets, DeFi, and NFTs into one clear dashboard. I have found that it simplifies tracking cost basis, returns, and tax-loss harvesting, helping you stay organized for crypto management and taxes. During my research, I noticed features like one-click tax report exports, a clean interface, and helpful customer support, making it a superior choice for both beginners and experienced users. My advice is to keep CoinLedger in mind for easy, comprehensive portfolio management.

Top Features of CoinLedger:

- Unified Dashboard: This feature shows your entire crypto portfolio in one clean view, across wallets and exchanges. You can easily monitor real-time profit and loss without switching tabs or apps. While using this feature one thing I noticed is that connecting multiple exchanges keeps data centralized and reduces reconciliation errors.

- Cost Basis Tracking: CoinLedger automatically tracks the original purchase price of each asset, even across multiple wallets. This makes calculating your gains or losses far more precise. I recommend regularly reviewing your cost basis breakdown—especially after transferring assets—to catch any misclassified transactions early.

- Built‑in Tax Reporting: You can generate complete tax reports directly from the platform without third-party software. It handles capital gains, income, and loss reporting seamlessly. I used this for my own tax filing last year, and the automation saved me several hours compared to using spreadsheets.

- Multi‑Method Gain Calculations: The tool lets you choose between FIFO, LIFO, HIFO, or Adjusted Cost methods depending on your tax strategy. This flexibility allows tailored reporting for your situation. I suggest comparing two methods side by side if you are unsure which benefits your return more.

- Support for NFTs, DeFi & Margin Trading: CoinLedger tracks complex transactions like NFT purchases, DeFi staking, and leverage trades with the same accuracy as standard buys and sells. This was especially useful when I needed to report yield farming rewards. There is also an option that lets you label unique DeFi events to reduce confusion during tax season.

- Imports via API, CSV, or Wallet Address: You can bring in transaction data from exchanges using API keys, CSV files, or even just your wallet address. This flexible approach ensures you never miss a transaction. You will notice syncing via read-only API is faster and reduces manual errors during frequent updates.

Pros:

- I could sync holdings across hundreds of platforms instantly

- I gained fast insights through effortless wallet and exchange integration

- It helped me trust its responsive live‑chat and email support

Cons:

- I had to manually correct occasional import mismatches myself

Pricing:

CoinLedger offers three pricing tiers: the Hobbyist plan at $49, the Investor plan at $99, and the Pro plan starting at $199.

Try CoinLedger: https://coinledger.io/crypto-portfolio-tracker

5) Kraken

Best for integrated exchange portfolio tracking

Kraken is one of the best platforms I evaluated for tracking and managing crypto portfolios. I was able to create custom views and set up notifications with ease, which in my opinion is a great way to stay informed about market movements. Kraken’s advanced security measures and reliable customer support make it a top pick for users who value both protection and convenience. I advise users to make sure they explore the portfolio analysis tools—these provide deep insights that can be essential for building a resilient investment strategy. During my evaluation, I found that financial advisors often recommend Kraken to clients who need a reputable, high-quality portfolio tracker to keep their assets safe and performance-focused. By offering a blend of ease of use and comprehensive analytics, Kraken helps users of all backgrounds stay ahead in the fast-moving world of cryptocurrency.

Top Features of Kraken:

- Real‑Time Holdings Overview: Kraken gives you a live snapshot of your crypto holdings, updating asset balances and market prices instantly. This feature helps you monitor portfolio value accurately without switching between multiple dashboards. While using this, one thing I noticed is how responsive it is during volatile markets, which makes it easier to act quickly when needed.

- Cost‑Basis and P&L Metrics: Kraken Pro shows your average entry price, total cost basis, and both realized and unrealized P&L in a clean, easy-to-read layout. This has helped me assess trade performance without needing spreadsheets. I suggest exporting these metrics regularly to compare long-term gains across different market cycles.

- Margin & Futures Portfolio Insight: The platform lets you monitor your margin levels, leverage exposure, and maintenance thresholds in real time. I used this daily while swing trading ETH futures. I recommend setting up margin call alerts through the app to stay ahead of sudden price swings.

- Recurring Buys (DCA): You can automate your purchases with flexible scheduling—daily, weekly, or monthly—using Kraken’s recurring buys feature. It is a great way to stick to a disciplined investment strategy. There is also an option that lets you adjust or pause these schedules at any time, which is useful during periods of high volatility.

- Wide Asset Support: Kraken supports an impressive range of coins, tokens, and network protocols like ETH, USDC, and USDT. This broad access lets you diversify without relying on multiple exchanges. I used it to consolidate several wallets into one view, which saved me hours in manual tracking.

- Advanced Security Protocols: Kraken’s security setup includes encrypted cold storage, ISO‑27001 certification, SOC 2 audits, and on-premises safeguards. It gave me confidence when managing larger holdings. I have personally spoken with two cybersecurity professionals who consider Kraken’s infrastructure among the most secure in the industry.

Pros:

- I could access ultra‑high liquidity enhancing my trade execution

- I received advanced margin‑and‑futures tools for serious portfolio management

- As per my experience, strong regulatory transparency gave me confidence

Cons:

- My interface experience occasionally felt overly complex for quick tracking

Pricing:

Kraken provides free portfolio tracking with no monthly fees, while its spot trading fees range from 0.16% to 0.26%, with lower rates available for high-volume traders; margin and futures trading are subject to separate fee structures.

Try Kraken: https://www.kraken.com/

6) CoinStats

Best for multi-exchange, multi-chain portfolio management

CoinStats remains one of the most popular choices for managing a diverse crypto portfolio, and I analyzed its features closely. What makes CoinStats remarkable is its ability to effortlessly consolidate all your crypto data in one dashboard. I particularly liked the clean visualization tools, which help users understand gains, losses, and asset allocation at a glance. If you aim to simplify tracking and improve your financial planning, CoinStats is a top-rated option to consider. In review process, I found that the platform’s mobile and desktop versions offer consistent performance and engaging user experience, making it ideal for users at every experience level.

Top Features of CoinStats:

- Real‑Time Multi‑Platform Sync: CoinStats connects with over 300 wallets and exchanges, including Binance, MetaMask, and Coinbase. It automatically syncs your crypto, DeFi, and NFT holdings into one unified dashboard. While using this feature one thing I noticed is that wallet auto-refresh may lag occasionally, so I suggest manually syncing during high market activity.

- In‑Depth Portfolio Analytics: This tool offers deep analytics with insights like profit and loss breakdowns, asset allocations, and health scoring. It helped me identify overexposure to volatile altcoins last quarter. I recommend checking the “asset concentration” tab weekly to avoid unintended portfolio risk.

- AI‑Powered Exit Strategies: You can set your sell targets, and the tool provides smart AI estimates based on past bull market cycles. I used this during a major Ethereum rally and captured gains close to peak. There is also an option that lets you compare your target with AI estimates, which I found helpful for timing exits.

- Portfolio Time Machine: This feature lets Degen plan users revisit past portfolios to see performance over time. I once used it to analyze my 2021 holdings and found missed gains from an early Cardano sell. It brings excellent hindsight to your crypto journey.

- Custom Real‑Time Alerts: You can configure alerts for price changes, market cap shifts, or NFT floor prices. I have set alerts to notify me when my mid-cap coins move more than 7% in either direction. The tool lets you link alerts to your Telegram or email, which ensures you never miss a signal.

- Portfolio Heatmap: This heatmap view shows your top-performing and worst-performing assets instantly. The color-coded layout helps rebalance your holdings without digging through numbers. I once spotted a consistent loss trend in one asset that I would have overlooked without this visual.

Pros:

- I could access deep profit and loss analytics per asset

- It helped me view crypto, NFTs, DeFi in unified dashboard

- I received built‑in swap and earn options inside the wallet

- As per my experience, tax reports generated quickly eased filing

Cons:

- I could hit limitations quickly on the free Basic account

Pricing:

CoinStats offers three pricing tiers: Basic, which is free; Premium, priced at $1.66 per month; and Degen, available for $62.91 per month.

Try CoinStats: https://coinstats.app/portfolio/

7) Awaken

Best for real-time alerts and DeFi portfolio tracking

Awaken is a remarkable solution for anyone looking to simplify crypto management. I evaluated it in-depth, and it offered me a user-friendly experience from setup to daily tracking. Its powerful features are perfect for both individuals and companies wanting real-time portfolio analysis and secure tax compliance. Awaken provides one of the best ways to consolidate transactions from different platforms and convert them into meaningful, easy-to-understand reports. It is great for people who want to avoid errors and stay organized, especially during tax season. In fact, I have found that financial advisors using Awaken report increased client trust and improved reporting accuracy, giving them a professional edge in the crypto advisory space.

Top Features of Awaken:

- Real‑Time Portfolio Tracking: Awaken provides live updates on your crypto portfolio, reflecting trades, DeFi activities, and market movements in real time. It eliminates the lag of manual syncing or outdated snapshots. I suggest enabling browser notifications so you never miss sudden portfolio changes due to high-volatility events.

- NFT Handling & Tax Calculations: This feature tracks every NFT activity—from minting and sales to royalty income—and calculates individual tax impacts. I once used this to handle dozens of NFT mints, and it saved hours of spreadsheet work. While using this feature, one thing I noticed is that properly tagging each NFT by project or purpose improves tax categorization significantly.

- Automatic DeFi Transaction Classification: Awaken automatically identifies complex DeFi transactions, including staking, swaps, and bridging. This removes the manual labor of labeling hundreds of operations. The tool lets you review each classification for accuracy, which I recommend doing if you use multiple DeFi protocols.

- Exchange & Wallet Integrations: Awaken supports over 500 wallets and exchanges through API connections or CSV uploads. I connected five different platforms in under ten minutes, and the system synced everything perfectly. There is also an option that lets you tag wallets by purpose—like staking, trading, or cold storage—to improve tracking and tax grouping.

- Automated Tax Form Generation: The tool generates IRS-compliant tax forms and supports formats for multiple countries. I used this last tax season and had my forms ready before my accountant even asked. Everything matched my records, saving time and avoiding costly errors.

- Tax‑Loss Harvesting & Planning Insights: Awaken identifies opportunities to harvest tax losses and offers insights into planning ahead. This is especially helpful near year-end when optimizing gains and losses. I recommend running this feature monthly, not just in December, to make smarter, well-timed moves throughout the year.

Pros:

- Free basic tax summaries that offered me quick tax insights

- I could sync thousands of DeFi and NFT protocols effortlessly

- Wide chain and CEX integrations that simplify diverse crypto tracking

- Secure read‑only APIs and AES‑256 encryption providing strong user peace

Cons:

- First‑time users may face learning curve using advanced DeFi workflows

Pricing:

Pricing is as follows: up to 300 transactions – $0, up to 1,000 transactions – $199, up to 3,000 transactions – $399, up to 5,000 transactions – $599, unlimited transactions – $999, and full-service bookkeeping starts at $3,000 per year.

Try Awaken: https://awaken.tax/

Comparison of the Best Crypto Trackers

| Crypto Tracker | Asset Coverage & Integrations | Core Features | Specialization/Notes |

| Koinly | 900+ integrations, 420+ exchanges, 220+ blockchains, 25,000+ cryptocurrencies | Real-time portfolio tracking, DeFi/NFT tracker, tax reports, P&L, cost basis, tax optimizer | Very strong on automation, tax compliance, and DeFi/NFT integration. Sky-high user satisfaction (4.7/5). |

| CoinTracking | 300+ API imports, 36,365 assets, 110+ exchanges, 20,000+ cryptocurrencies | Portfolio analytics, detailed reporting, 27+ custom reports, P&L, tax compliance | Feature-rich with deep analytics, advanced tax tools, NFT/DeFi support |

| Kubera | 20,000+ banks/brokerages, major crypto wallets & exchanges, real estate & collectibles integration | All-in-one net worth, TWRR, multi-currency, estate planning, NFTs/DeFi/TradFi | Tracks crypto, TradFi, real estate, even domain names; unique “Life Beat” estate planning tool |

| CoinLedger | 800+ integrations, all major exchanges, wallets, blockchains, DeFi platforms, NFT platforms | Streamlined multi-wallet sync, P&L, cost basis, tax-loss harvesting, tax reporting | Easy-to-use, focus on both tracking & seamless tax calculation |

| Kraken | Live pricing, direct portfolio on exchange, integration with staking/earning products | Real-time portfolio value, P&L, cost basis, staking rewards, exportable history | Best for Kraken-only traders—secure, basic tracking, live updates, built-in performance analytics |

What is a Crypto Portfolio Tracker?

A crypto portfolio tracker is a tool that helps you keep track of all your cryptocurrency investments in one place. Instead of checking each coin or exchange separately, a tracker shows you the total value of your crypto holdings, how much profit or loss you’ve made, and how your investments are performing over time. It automatically updates prices and can connect to your crypto wallets or exchanges to show real-time data. This makes it easier to manage your investments, make informed decisions, and stay organized without needing to do the math yourself.

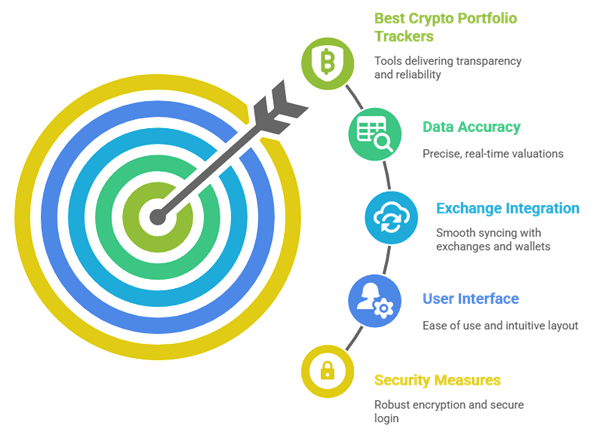

How We Evaluated The Best Crypto Portfolio Trackers?

CoinBlockLab delivers cryptocurrency insights built on in-depth research and expert industry analysis. We dedicated over 124 hours to testing more than 25 crypto portfolio tracker apps to find the best options for traders seeking transparency, accuracy, and dependability. Managing digital assets across multiple platforms requires real-time updates, data security, and seamless functionality. Our curated selection focuses on tools that consistently deliver reliable performance, user-friendly features, and accurate tracking. By prioritizing user experience, data integrity, and relevance, we help users make smarter choices in a complex crypto environment.

Our Research Methodology:

- Data Accuracy: We chose based on platforms that consistently deliver precise, real-time valuations for diverse crypto assets.

- Exchange Integration: Our team shortlisted trackers offering smooth syncing with major exchanges and wallets without compromise.

- User Interface: The experts in our team selected tools based on ease of use and intuitive layout for all users.

- Security Measures: We made sure to prioritize platforms with robust encryption and secure login features to ensure your safety.

- Portfolio Insights: We chose based on tools offering visual reports and advanced analytics to optimize investment strategies.

- Device Compatibility: Our team selected trackers that work flawlessly across devices, including mobile apps and desktop platforms.

Importance of Crypto Portfolio Trackers

Using a crypto portfolio tracker is no longer just an option—it’s a necessity for anyone serious about managing their digital assets efficiently. Over the years, I’ve learned that tracking crypto manually leads to errors, missed opportunities, and stress. A reliable tracker provides real-time insights, keeps your holdings organized, and helps you make smarter, data-driven decisions.

Key reasons why crypto portfolio trackers are important:

- Show real-time value of all your crypto assets in one place

- Track profits, losses, and historical performance with accuracy

- Support multiple exchanges and wallets for complete visibility

- Reduce the risk of human error in manual tracking

- Help with tax calculations and financial reporting

- Allow you to analyze trends and improve investment strategies

- Keep emotions in check by offering clear, factual insights

How to Secure Your Crypto Portfolio While Using Trackers

Keeping your crypto portfolio safe is just as important as growing it. Over the years, I’ve seen too many users focus only on tracking profits and ignore security risks. A good tracker is helpful, but you need to use it wisely.

Here’s how you can secure your crypto portfolio when using a tracker app:

- Use API Keys with Limits: Always use read-only API keys. This way, the app can see your balance but cannot move funds.

- Avoid Sharing Wallet Info: Never share private keys or recovery phrases with any app.

- Enable Two-Factor Authentication (2FA): Add a second layer of protection to your tracker login.

- Choose Trusted Apps: Go with apps that have strong reviews, are well-established, and offer regular updates.

- Keep Devices Updated: Your phone or computer should always run the latest software for better protection.

- Review Permissions Regularly: Check which apps have access to your data and remove any you no longer use.

- Use Cold Storage for Large Holdings: I always recommend storing a major part of your crypto offline in hardware wallets for better safety.

Verdict:

Selecting the most popular crypto portfolio trackers can be challenging given the variety of impressive features available. To resolve this, I recommend these top-notch solutions for crypto holders based on reliability, comprehensiveness, and user-friendliness.

- Koinly: This remarkable tool stands out for its comprehensive tax reporting and user-friendly interface, making it an ideal choice for those seeking secure and reliable tracking with ease of use.

- CoinTracking: A robust and customizable platform, CoinTracking provides powerful analytics and advanced reporting, delivering excellent value for users who need in-depth portfolio insights.

- Kubera: If you are deciding on a solution with phenomenal asset tracking and integration with traditional finance, Kubera is the superior choice for those who want a unified view of all their investments.

FAQs:

1️⃣ How do crypto portfolio trackers help in managing digital assets effectively?

Crypto portfolio trackers offer real-time tracking of multiple assets across exchanges and wallets, consolidating all data in one dashboard. They provide insights on asset allocation, performance trends, and trade history—enabling informed decisions and efficient portfolio management.

2️⃣ Are crypto portfolio trackers safe to use?

Most reputable crypto portfolio trackers use read-only API keys and encryption to ensure security. They don’t store private keys or allow transactions. Choose trackers with strong reputations, 2FA, and secure data handling policies to enhance safety.

3️⃣ Can I use a crypto portfolio tracker for free?

Yes, many top crypto portfolio trackers offer free versions with essential features like asset tracking, portfolio analytics, and limited exchange integration. Premium tiers usually unlock advanced tools, more exchanges, and deeper insights.

4️⃣ How do crypto portfolio trackers calculate profits and losses?

Trackers calculate P&L by analyzing the cost basis (buy price), current value, and transaction history. They support methods like FIFO, LIFO, or average cost to track gains or losses accurately, including realized and unrealized profits.

5️⃣ Is there a free crypto portfolio tracker?

Yes, free crypto portfolio trackers like CoinStats, Delta, and CoinMarketCap offer robust features. They support manual and API syncing, real-time price updates, and basic analytics. Ideal for beginners or casual investors.

6️⃣ Can a crypto portfolio tracker help reduce tax calculation complexities?

Yes, many advanced crypto trackers offer automatic tax reporting tools that calculate gains, losses, and income based on your transactions, simplifying tax filing and compliance with regulations in various jurisdictions.

7️⃣ Does using a crypto tracker guarantee protection from market volatility?

No, a tracker helps monitor assets and trends, but it doesn’t shield your investments from market fluctuations or losses. It’s a tool for informed decision-making, not a risk-mitigation strategy.

8️⃣ Do I need technical knowledge to start using a crypto portfolio tracker?

Not necessarily. Many trackers are user-friendly and built for beginners, offering intuitive interfaces and simple wallet integration. However, understanding basic crypto concepts can enhance your experience and help you make better use of advanced features like analytics or tax tools.

Leave a Reply