Key Takeaway

Choosing the best crypto exchanges in Canada starts with safety. It also starts with fees. It also starts with simple usability. Many traders compare platforms like Kraken, Bitbuy, Coinbase, and Crypto.com. These names offer solid liquidity and broad asset access.

- Canada-friendly access matters. Look for CAD deposits and fast withdrawals.

- Security is not optional. Prioritize strong custody and account protection.

- Fees can quietly drain returns. Trading and spread costs add up.

- Product fit matters. Spot, staking, and derivatives differ by exchange.

- Purpose of this guide: Help Canadians select the best crypto exchange based on objective criteria.

- Who it’s for: Beginners, active traders, long-term holders, and institutional users in Canada.

- What “best” means: Lowest total cost (fees + spreads), strong security and custody, reliable CAD funding and withdrawals, sufficient asset and product coverage, and clear usability.

- Regulation note: In Canada, oversight by the Canadian Securities Administrators (CSA) and the Canadian Investment Regulatory Organization (CIRO) matters because it signals compliance, investor protections, and operational transparency.

Our Methodology to Review How We Evaluate Crypto Exchanges in Canada

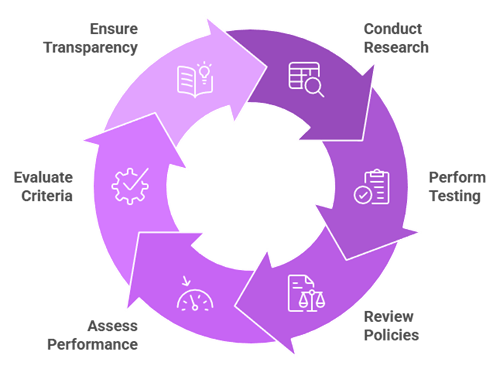

Our methodology for How We Evaluate Crypto Exchanges in Canada is built on structured research, hands-on testing, and verifiable data to deliver accurate, decision-ready insights for Canadian users. We assess platforms under real market conditions, with attention to regulatory context and practical usability.

Testing includes account setup, trade simulations, fee verification, policy reviews, and performance checks. Reviews are conducted independently, with clear disclosure of any affiliations to ensure transparency and trust.

We evaluate exchanges across core criteria:

- Safety & custody: cold storage, insurance, proof-of-reserves (where available), and account protections

- Compliance in Canada: registrations, regulatory undertakings, and access restrictions

- Costs & value: trading fees, spreads, deposit/withdrawal and FX fees

- CAD money movement: Interac e-Transfer, wire, bank transfer, cards, and settlement times

- Assets & features: BTC/ETH, altcoins, stablecoins, spot trading, recurring buys, orders, APIs, staking

- User experience & support: onboarding, app quality, responsiveness

- Transparency: fee disclosures, execution quality, conflicts

Crypto Exchanges Canada Quick Decision List

| Exchanges | Crypto Exchange Best For |

| Zengo | Best for secure self-custody trading without private keys |

| Kraken | Best for advanced trading and strong security standards |

| Uphold | Best for multi-asset trading across crypto and fiat |

| Bitbuy | Best for Canadian-friendly compliance and ease of use |

| Coinbase | Best for beginners seeking a simple crypto experience |

| Crypto.com | Best for crypto rewards, cards, and all-in-one app |

| NDAX | Best for crypto exchange with low fees Canada |

How Crypto Exchanges Work in Canada

Overview of Crypto Exchanges in Canada

Crypto exchanges in Canada act as digital marketplaces where users can buy, sell, and trade cryptocurrencies like Bitcoin and Ethereum. These platforms connect buyers and sellers, manage order matching, and provide wallets to store digital assets. Most Canadian exchanges support transactions in Canadian dollars (CAD), making them convenient for local users.

Centralized vs Decentralized Exchanges in Canada

Centralized exchanges (CEXs) are run by companies, support CAD deposits, and follow Canadian regulations, making them beginner-friendly and convenient. They handle custody, security, and customer support. Decentralized exchanges (DEXs) operate on blockchains using smart contracts, allowing users to trade directly from their own wallets. While DEXs offer greater control and privacy, they require more technical knowledge and don’t support direct CAD payments.

Regulatory Framework and Compliance

Crypto exchanges operating in Canada must follow strict regulatory requirements. They are overseen by organizations such as the Canadian Securities Administrators and must register as money services businesses with FINTRAC. This ensures compliance with anti-money laundering (AML) and know-your-customer (KYC) rules, helping protect users from fraud and illegal activity.

How Users Trade Crypto

To get started, users create an account, verify their identity, and fund it using options like Interac e-Transfer or bank wire. Once funded, they can place buy or sell orders at market price or set limit orders. The exchange executes trades and updates balances in real time.

Fees, Security, and Custody

Canadian crypto exchanges typically earn revenue through trading fees, spreads, or withdrawal charges. Reputable platforms use security measures such as cold storage, encryption, and two-factor authentication to safeguard user funds, building trust and reliability for Canadian investors.

Top Crypto Exchanges for Canadians (Quick List)

| Platform | Type | CAD Support | Custody | Typical Fees | Notes |

| Zengo | Wallet (Non-custodial wallet + on-ramp) | ✔ | Self-custody | Variable (partner fees + network) | Secure MPC wallet; buy/sell via integrated on-/off-ramps; not a central exchange. |

| Kraken | Centralized Exchange | ✔ | Exchange custody | ~0.1%–0.4% trading | Regulated for Canada, large coin selection, good for intermediate & advanced traders. |

| Uphold | Centralized Exchange & Multi-Asset Platform | ✔ | Exchange custody | ~0.8%–1.2% | Multi-asset (crypto + stocks + metals), transparent reserves, good CAD options. |

| Bitbuy | Canadian Crypto Exchange | ✔ | Exchange custody | ~0.5% (spread-based) | Canadian-focused, regulatory compliant, simpler for locals but smaller coin list. |

| Coinbase | Centralized Exchange | ✔ | Exchange custody | ~0.4%–1% | Very beginner-friendly global exchange with strong security and regulatory presence in Canada. |

| Crypto.com | Centralized Exchange & App | ✔ | Exchange custody | ~0.18%–0.50% | Large coin list, many features (cards, staking), regulated presence but mixed user feedback. |

Best Crypto Exchanges in Canada (In-Depth Reviews)

1) Zengo

Best for secure self-custody trading without private keys

Zengo is a modern crypto wallet platform designed to remove common barriers faced by new crypto users. It operates with a strong focus on safety-first architecture and long-term user trust. Instead of relying on traditional private keys, Zengo uses advanced cryptographic methods to reduce single-point failure risks.

From my experience watching retail adoption trends, tools like Zengo gain credibility through consistency, not hype. The platform has built a solid market reputation for transparency, steady updates, and responsible security practices. It is widely regarded as reliable by industry reviewers and everyday users alike.

Zengo is best suited for beginners, long-term holders, and users who value ease of use over complex trading interfaces. It also works well for mobile-first users who prefer managing assets without technical friction.

Features

- Keyless Security: Eliminates traditional private keys using advanced cryptographic computation

- MPC Technology: Uses multi-party computation to split and secure wallet access

- Mobile-First Design: Optimized interface built specifically for smartphone-based usage

- Biometric Login: Face recognition or fingerprint access replaces password dependence

- Cloud Backup Recovery: Encrypted recovery process prevents permanent asset loss

- Multi-Asset Support: Supports major cryptocurrencies and selected stablecoins

- Built-In Swap Function: Allows asset exchanges directly within the wallet

- Fiat On-Ramps: Enables cryptocurrency purchases using supported local payment methods

- Portfolio View: Real-time balance tracking across all supported assets

- Non-Custodial Structure: Users retain ownership without centralized custody

- Compliance Alignment: Operates within regulatory frameworks across supported regions

Pros

- The security feels genuinely solid with no seed phrase to lose

- The wallet never has been hacked since its launch

- I find the interface clean and very beginner-friendly

- Customer support response is prompt and helpful

- Buying and selling crypto is easy and intuitive

Cons

- I find premium features locked behind subscription paywall

- You cannot send, receive, or store native Cardano (ADA) in a Zengo wallet

Visit: https://zengo.com/

2) Kraken

Best for advanced trading and strong security standards

Kraken has established itself as a reliable cryptocurrency exchange since its 2011 launch in San Francisco. The platform serves over 10 million users globally, including a growing Canadian user base. Kraken prioritizes security through cold storage, regular audits, and regulatory compliance across multiple jurisdictions. The exchange holds licenses in various regions, demonstrating its commitment to legal operations.

Canadian traders benefit from direct CAD funding options and local payment methods. Kraken caters to beginners through its simplified interface while offering advanced features for experienced traders. I find their customer support responsive, especially for verification and technical issues. The platform maintains transparency about reserve holdings and operational practices. New users can start with minimal deposits, making crypto accessible to cautious investors. Kraken also provides extensive educational content to help beginners navigate digital asset markets confidently.

Features

- CAD Trading Pairs: Direct Canadian dollar support for seamless local transactions

- Staking Rewards: Earn passive income on 15+ cryptocurrencies through native staking

- Advanced Order Types: Stop-loss, take-profit, and margin trading for strategic execution

- Kraken Pro: Professional-grade charting tools with customizable technical analysis indicators

- OTC Desk: Personalized service for high-volume trades exceeding $100,000 CAD

- Instant Buy: Quick purchasing option for beginners using debit cards

- Cold Storage: 95% of user funds secured in offline wallets

- Futures Trading: Leverage up to 50x on Bitcoin and altcoin contracts

- Mobile App: Full-featured iOS and Android applications for trading anywhere

- API Access: Automated trading capabilities for algorithmic and bot strategies

- Kraken Wallet: Self-custody solution with multi-chain support and DeFi integration

Pros

- Industry-leading fee structure starts at just 0.16% per trade.

- Advanced traders access margin trading with up to 5x leverage.

- Comprehensive educational resources help beginners understand complex trading concepts effectively.

- Deposit methods are practical for many Canadian users.

Cons

- Some users report slow support and automated replies.

- I have seen verification delays during busy onboarding waves.

Visit: https://www.kraken.com/

3) Uphold

Best for multi-asset trading across crypto and fiat

Uphold is a globally recognized digital asset platform founded in 2015, designed to simplify crypto access for everyday users. Over the years, it has built a reputation around transparency, regulatory alignment, and operational consistency across multiple jurisdictions. The platform emphasizes a security-first philosophy, regularly publishing reserve disclosures to reinforce trust.

Uphold is generally viewed as reliable, particularly for users who value clarity over complexity. Its approach appeals to beginners and intermediate traders who want exposure to cryptocurrencies without navigating overly technical systems. I have seen many first-time traders feel more confident using platforms that prioritize openness. In my experience, Uphold resonates strongly with users who want to buy, hold, and transfer assets with minimal friction.

Features

- Multi-Asset Support: Trade cryptocurrencies, fiat currencies, and precious metals seamlessly

- Global Availability: Accessible in numerous countries with region-specific compliance support

- Transparent Reserves: Publicly available proof-of-reserves updated regularly for accountability

- One-Step Trading: Convert between supported assets without intermediate trading pairs

- Integrated Wallet: Built-in wallet for holding assets directly within the platform

- Recurring Transactions: Automated purchases scheduled at fixed intervals easily

- Cross-Asset Swaps: Instantly exchange crypto, fiat, or metals within one interface

- Mobile Application: Full-featured mobile app available for iOS and Android

- Regulatory Alignment: Operates under multiple international regulatory frameworks

- Educational Resources: In-app learning materials designed for beginner-level users

Pros

- I appreciate the platform transparency around reserves and asset backing.

- Asset conversion happens quickly without complicated trading steps.

- Supports diverse assets beyond cryptocurrencies, including metals and fiat.

- Account setup remains simple compared to many competing exchanges.

Cons

- Fees can feel high compared to advanced trading platforms.

- I noticed limited charting tools for deeper technical analysis.

- Advanced traders may find the platform too simplified for strategies.

Visit: https://uphold.com/

4) Bitbuy

Best for Canadian-friendly compliance and ease of use

Bitbuy is a Canada-based cryptocurrency trading platform built specifically for local investors. Founded with compliance as a priority, it operates under Canadian regulatory oversight, which strengthens its credibility among cautious users. The platform emphasizes transparent operations, strong custody practices, and clear communication with customers.

From a market perspective, Bitbuy has earned a solid reputation for reliability rather than hype. It is often viewed as a gateway exchange for users who want exposure to digital assets without navigating complex offshore platforms. I have seen many first-time traders prefer Bitbuy because it feels familiar and aligned with Canadian financial standards. It is best suited for beginners, long-term holders, and users who value security and simplicity over advanced trading complexity.

Features

- Regulatory Compliance: Registered and compliant with Canadian financial authorities

- Asset Custody: Majority of funds stored in insured cold storage

- Fiat Integration: Direct Canadian dollar deposits and withdrawals supported

- Trading Interface: Clean interface designed for straightforward buying and selling

- Mobile Access: Dedicated mobile apps available for iOS and Android users

- Asset Selection: Supports popular cryptocurrencies focused on mainstream demand

- Verification Process: Identity checks aligned with Canadian compliance requirements

- Account Funding: Multiple funding methods tailored for Canadian banking systems

Pros

- The platform is easy to navigate for new users.

- Strong Canadian regulatory alignment increases overall trust.

- I appreciate the clear fee transparency during transactions.

- Reliable fiat withdrawals reduce stress during market volatility.

Cons

- Advanced traders may find limited trading tools restrictive.

- I feel asset variety could improve over time.

- Fees may seem higher compared to global exchanges.

Visit: https://bitbuy.ca/en-ca

5) Coinbase

Best for beginners seeking a simple crypto experience

Coinbase is one of the most recognized crypto platforms globally. In Canada, Coinbase Canada, Inc. operates as a Restricted Dealer. It is also registered with FINTRAC as a money services business. Its security philosophy leans on layered controls and risk reduction. It also emphasizes regulatory compliance and customer protection commitments. I like Coinbase for first-cycle learners needing guardrails. I also use it when onboarding friends into crypto basics. Forbes notes it can suit beginners and advanced traders. It is best for Canadians who value familiarity and structured processes. It also fits users who prefer a compliance-forward trading environment.

Features

- Canadian Platform Access: Coinbase Canada portal supports localized product disclosures.

- Regulatory Status: Registered Restricted Dealer and FINTRAC MSB in Canada.

- Two-Step Verification: Required 2FA for account access and protection.

- Security Controls: Security-key support and password protections for accounts.

- Coinbase Vault: Multi-approval withdrawals available for added transaction control.

- Advanced Trade: Order entry supports limit and stop-limit orders.

- Recurring Buys: Scheduled purchases available in app and web.

- Earn Hub: Staking and rewards programs available through Coinbase Earn.

- Coinbase Wallet Option: Self-custody wallet exists separate from exchange accounts.

- Wallet Permission Tools: Review and revoke dapp connections within Wallet.

Pros

- We can onboard quickly with clear, guided verification steps.

- Many users praise the app’s ease of use.

- Compliance posture signals a more conservative operating culture.

Cons

- Fees can feel steep for small, frequent transactions.

- I have seen support delays during account restriction reviews.

Visit: https://www.coinbase.com/en-ca

6) Crypto.com

Best for crypto rewards, cards, and all-in-one app

Crypto.com launched in 2016 and has grown into a globally recognized exchange serving millions of users. The platform emphasizes institutional-grade security through cold storage protocols and regular third-party audits. Canadian traders benefit from CAD deposit support and regulatory compliance within local frameworks.

The exchange prioritizes user protection with multi-layered security measures. Insurance coverage protects digital assets stored on the platform. I have observed that their transparent fee structure helps traders plan costs effectively.

Crypto.com suits both beginners exploring their first Bitcoin purchase and active traders managing diverse portfolios. The mobile-first design reflects modern trading habits. Educational resources help users understand blockchain fundamentals and trading strategies.

The platform’s native CRO token unlocks tiered benefits across services. Liquidity remains strong across major trading pairs. Their customer support operates globally with multilingual assistance. The company maintains partnerships with major sports organizations, signaling long-term market commitment.

Features

- Fiat Onramps: Direct Canadian dollar deposits through trusted banking partners

- Crypto Cards: Spend crypto balances using prepaid Visa card rewards

- Earn Program: Interest earning options on supported digital assets

- NFT Marketplace: Integrated platform for discovering and trading digital collectibles

- Staking Support: On platform staking for selected proof of stake assets

- DeFi Wallet: Separate non custodial wallet for decentralized finance access

- Multi Asset Support: Broad range of cryptocurrencies available for trading

- Compliance Framework: Adheres to regional regulations across supported markets

- Customer Support: In app assistance with ticket based resolution system

Pros

- Strong brand recognition increases trust among new crypto investors.

- Mobile app performance remains stable during high traffic periods.

- Multiple crypto services reduce the need for external platforms.

Cons

- I find advanced trading tools limited compared to professional exchanges.

- Customer support response times vary during market volatility.

Visit: https://crypto.com/en

7) NDAX

Best for crypto exchange with low fees Canada

NDAX is a Canada-focused crypto trading platform and brokerage. It positions itself around operational discipline and transparent practices. Its security philosophy emphasizes segregation, layered controls, and offline storage. The company also highlights incident coverage and insured custody arrangements.

Market reputation is mixed but established, with steady visibility in Canada. I view it as a practical on-ramp for bank-linked users. I also like platforms that publish security and compliance details. NDAX tends to suit beginners, long-term holders, and compliance-minded traders. It can also fit intermediate traders who value straightforward execution.

Features

- Cold storage custody: Majority of assets stored offline with multi-signature controls.

- Ledger Vault integration: Institutional-grade custody infrastructure used for safeguarding holdings.

- Insurance coverage: Disclosed wallet insurance for certain insurable incidents.

- Segregated fiat accounts: Client fiat held separately at Canadian institutions.

- Multi-signature approvals: Sensitive operations require multiple approvals before execution.

- Staking support: Offers staking on selected supported cryptocurrencies.

- Business liability coverage: Discloses general business liability insurance coverage.

Pros

- Clear costs make budgeting simpler for regular traders.

- I find onboarding straightforward for bank-connected Canadian users.

- Security disclosures increase confidence when storing assets temporarily.

- We value the published custody and insurance transparency.

Cons

- Coin selection may feel limited for active alt traders.

- Some users report delayed withdrawals and stuck transfers.

Visit: https://ndax.io/en

Fees Explained: What Canadians Should Know

When choosing the best crypto exchange in Canada, understanding fees is essential because they directly affect your returns. Most Canadian exchanges charge trading fees, typically ranging from 0.1% to 0.5% per transaction, depending on whether you’re a maker or taker. You may also encounter deposit and withdrawal fees, especially when funding your account via Interac e-Transfer, bank wire, or withdrawing crypto to an external wallet.

Another often-overlooked cost is the spread—the difference between buy and sell prices—which can be higher on beginner-friendly platforms. Canadians should also watch for currency conversion fees when trading in CAD versus USD. To minimize costs, compare fee structures carefully, trade larger amounts less frequently, and always review the exchange’s fee schedule for transparency.

Must Read Guides

Best Tradingview Alternatives

Security Tips for Using Crypto Exchanges

Security should be a top priority when choosing and using the best crypto exchange in Canada. While reputable exchanges invest heavily in safeguards, individual users also play a critical role in protecting their assets. Following proven security practices can significantly reduce the risk of hacks, scams, and unauthorized access.

- Enable two-factor authentication (2FA): Always activate 2FA using an authenticator app rather than SMS to add an extra layer of protection to your account.

- Use strong, unique passwords: Create complex passwords that are not reused on other platforms, and consider using a trusted password manager.

- Verify exchange security features: Choose exchanges that offer cold storage, insurance coverage, and transparent security policies tailored to Canadian regulations.

- Beware of phishing attempts: Double-check website URLs, avoid clicking suspicious links, and never share login credentials or recovery phrases.

- Withdraw long-term holdings: For added safety, store large or long-term crypto holdings in a personal hardware wallet instead of leaving them on an exchange.

- Keep software up to date: Regularly update your devices, browsers, and security software to protect against vulnerabilities.

Funding Your Crypto Account in Canada

Funding your crypto account in Canada is straightforward, with several secure options designed for speed and compliance. Choosing the right method depends on how quickly you want to trade, your budget, and your comfort with fees and limits. Below are the most common ways Canadians fund accounts on the best crypto exchanges.

- Interac e-Transfer: Interac e-Transfer is the most popular funding method in Canada. It’s fast, widely supported, and typically comes with low or no fees. Most deposits are processed within minutes to a few hours, making it ideal for beginners and active traders alike.

- Bank Wire Transfers: Bank wires are best suited for larger deposits. While they offer higher limits and strong security, processing times are slower—usually 1–5 business days—so they’re better for long-term investors than quick trades.

- Credit/Debit Cards: Cards provide instant funding but often come with higher fees and lower limits. Some banks may also block crypto-related transactions.

- Processing Times and Limits: Processing speed and deposit limits vary by exchange and method, so always check platform-specific details before funding your account.

Crypto Taxes in Canada

In Canada, cryptocurrency is not considered legal tender, but it is taxable. The Canada Revenue Agency (CRA) treats crypto as a commodity, meaning most transactions trigger a tax event. If you sell, trade, or use crypto to buy goods or services, you may incur capital gains or losses. Generally, 50% of any capital gain is taxable at your marginal tax rate.

If you’re actively trading, mining, or earning crypto through staking or rewards, the CRA may classify this as business income, which is fully taxable. Keeping detailed records is essential—track purchase prices, sale values, transaction dates, and fees. Many Canadian exchanges provide transaction histories, but using a dedicated crypto tax tool can simplify reporting. Staying compliant helps you avoid penalties and ensures peace of mind as you invest.

Common Mistakes Canadians Make When Choosing an Exchange

Canadians often rush into choosing a crypto exchange without fully evaluating whether the platform is regulated and compliant with Canadian laws. This can lead to security risks, frozen funds, or limited legal protection if the exchange runs into trouble. Focusing only on low fees or popular branding, rather than long-term reliability, is a common misstep.

Another mistake is overlooking practical factors like CAD deposits, withdrawals, and customer support. An exchange that doesn’t efficiently support Canadian dollars or offer responsive assistance can quickly become frustrating when problems arise or market conditions change.

Common mistakes to avoid include:

- Choosing an exchange that is not registered or compliant with Canadian regulations

- Ignoring how easy and affordable it is to deposit or withdraw CAD

- Overlooking security features such as cold storage and two-factor authentication

- Failing to research the exchange’s reputation and recent user reviews

- Underestimating the importance of reliable customer support

FAQs

Are crypto exchanges legal in Canada?

Yes, crypto exchanges are legal in Canada. Platforms must register with Canadian regulators, follow AML/KYC rules, and comply with securities laws. Legal exchanges operate transparently, safeguard user funds, and provide tax records—making regulated platforms the safest option for Canadian residents trading or holding cryptocurrencies.

What is the safest crypto exchange in Canada?

Safety depends on regulation, custody, and security practices. Bitbuy is considered one of the safest due to full Canadian registration, cold-storage custody, insurance coverage, and strict compliance standards. It’s well-suited for Canadians prioritizing regulatory protection, transparent operations, and reliable customer support.

Can Canadians use international exchanges?

Yes, Canadians can use some international exchanges, but availability depends on local compliance. Platforms like Kraken accept Canadian users and meet regulatory requirements. However, some global exchanges restrict Canada access, so users should verify registration status, supported payment methods, and legal compliance before signing up.

Which exchange has the lowest fees in Canada?

For low fees, Newton is popular. It charges zero trading commissions, earning through small spreads instead. Newton also supports free deposits and withdrawals, making it cost-effective for frequent traders. Always compare spreads and funding fees, as “zero-fee” doesn’t always mean lowest total cost.

Do I need to report crypto transactions?

Yes. Crypto transactions must be reported to the Canada Revenue Agency. Trading, selling, or using crypto can trigger capital gains or business income taxes. Keeping accurate records of trades, prices, and dates is essential, as unreported crypto activity can lead to penalties or audits.

Final Verdict: Choosing the Best Crypto Exchange in Canada

I have followed the crypto exchange landscape in Canada closely, focusing on security, fees, compliance, and usability. My perspective comes from years of reviewing platforms through real trading scenarios. If you are deciding today, check my verdict to see which option fits practical needs best.

- Zengo stands out as a top-notch and secure option with its keyless wallet model, which reduces common custody risks and suits users who value simplicity.

- Kraken remains a superior choice for traders who prioritize deep liquidity, transparent fees, and robust compliance, making it a reliable and powerful platform.

- Uphold delivers impressive versatility by supporting multiple asset classes in one place, which I find ideal for diversification.