Key Takeaway: Safest Crypto Exchanges

Safest crypto exchanges protect funds through strong custody, compliance, and security practices. Platforms like Zengo, Kraken, Coinbase, and Binance often lead discussions. They combine advanced security systems with user focused protections for everyday traders.

- Safest crypto exchanges prioritize asset custody, transparency, and regulatory alignment.

- Security features often include cold storage, audits, and strict access controls.

- Reliable exchanges reduce risks from hacks, fraud, and operational failures.

- Strong user education and support improve confidence for new market participants.

Choosing the wrong crypto exchange can expose users to serious financial risks. Weak security, poor compliance, and hidden practices often lead to losses. Many beginners overlook these issues while chasing lower fees. I have seen traders lose funds due to unreliable platforms. Poor tools can cause frozen withdrawals and data breaches. They also create stress during volatile market conditions. Proper and trusted exchanges reduce these risks significantly. This article helps readers identify safer crypto exchanges. It offers honest insights based on real market experience.

Introduction: Why Exchange Security Matters

Why Exchange Security Matters

As crypto adoption reaches new highs in 2025, the threat landscape has evolved just as rapidly. Exchanges now safeguard vast amounts of digital capital, making them high-value targets for increasingly sophisticated cyberattacks. With more than $3.4 billion lost to breaches this year—including the $1.5 billion ByBit incident—security is no longer a feature. It is the core infrastructure of digital asset protection.

Trading Risk vs. Platform Risk

Risk in crypto operates on two distinct layers. Trading risk stems from market volatility and decision-making. Platform risk, however, arises when an exchange itself fails—through hacks, insolvency, or restricted withdrawals—putting user funds directly at risk.

Who This Guide Is For

This guide is built for beginners, long-term holders, and active traders who want a clear, practical framework for safeguarding assets in a high-risk digital environment.

What Makes a Crypto Exchange “Safe”?

When writing about Safest Crypto Exchanges, safety is not just about technology. It is about how the platform protects users at every level. From my experience, a safe exchange combines strong systems with responsible operations.

Core Security Features

- Two-factor authentication to block unauthorized access

- Cold storage for most user funds to reduce hacking risk

- Encryption that protects personal and transaction data

- Regular security audits to find and fix weaknesses

These features lower technical risks and protect assets even during attacks.

Operational & Corporate Safety

- Clear regulatory compliance in trusted regions (e.g., U.S. FinCEN, EU MiCA)

- Transparent ownership and leadership details

- Insurance coverage for digital assets where possible

- Proven track record with no major unresolved breaches

I believe operational discipline matters as much as code. A crypto exchange becomes truly safe when it blends strong security tools with honest business practices. This balance builds trust and long-term reliability for beginners and experienced users alike.

Which is the most secure crypto exchange?

- Zengo: Best for self-custodial wallet security

- Kraken: Best for regulated exchange security

- Coinbase: Best for insured fiat protection

- Binance: Best for large-scale security infrastructure

- PrimeXBT: Best for secure margin trading

- ChangeNOW: Best for non-custodial exchange safety

- Bybit: Best for derivatives platform security

- OKX: Best for compliance-driven security

Evaluation Criteria Used in This Ranking

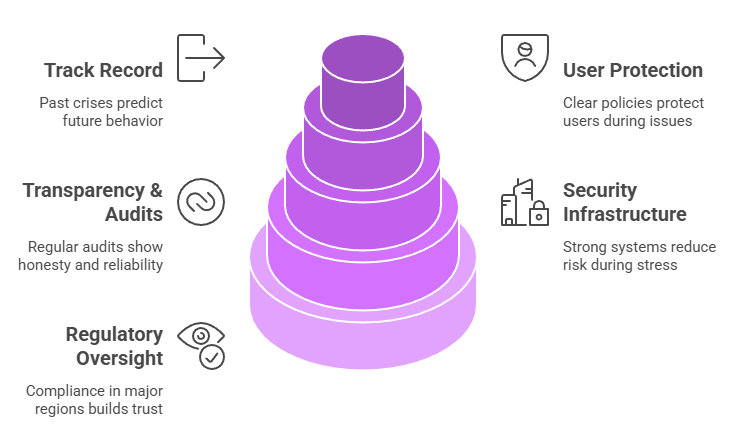

To rank the Safest Crypto Exchanges, I focused on clear and practical factors that matter to everyday users. Safety is not just about technology. It is about trust built over time.

- Regulatory oversight came first. Exchanges that follow rules in major regions offer better user confidence. Licensing also shows long-term intent, not quick profit.

- Security infrastructure was closely compared. I looked at cold storage use, two-factor login, and breach response plans. Strong systems reduce risk, even during market stress.

- Transparency and audits matter more than marketing. Regular third-party audits and public proof of reserves show honesty. Hidden data is always a red flag.

- User protection policies were another key point. Clear insurance terms, withdrawal controls, and account recovery steps protect users during issues.

- Track record and reputation helped separate theory from reality. I trust platforms that have handled past crises without harming users. My experience shows history often predicts future behavior.

Top Safest Crypto Exchanges (Detailed Reviews)

1) Zengo

Expert Insights: Why Consider Zengo?

Zengo stands out in conversations about the safest crypto exchanges and wallets. For beginners navigating security risks, this platform offers a confidence-first approach. It is backed by a strong focus on protection and simplicity, making adoption feel perfectly manageable.

Zengo is a crypto wallet platform designed with security as its foundation. It removes traditional private key vulnerabilities by using advanced cryptographic methods, reducing common user errors. Over time, it has built a solid market reputation for prioritizing safety over speculation.

The platform follows a security-first philosophy, backed by continuous audits and transparent practices. This approach has earned trust among users who value protection more than complex trading tools. Zengo is best suited for beginners, long-term holders, and risk-aware investors.

I have seen many users prefer Zengo after experiencing wallet security failures elsewhere. From a strategist perspective, its reliability makes it appealing for cautious market participants entering crypto.

Zengo Standout Features

- Keyless Security: Eliminates private keys using advanced multi-party computation technology

- Biometric Login: Facial recognition access adds an extra protective authentication layer

- Non-Custodial Wallet: Users retain full ownership of digital assets

- Cross-Platform Access: Seamless usage across mobile devices and operating systems

- Built-In Recovery: Loss protection without traditional seed phrases

- Asset Support: Supports major cryptocurrencies and popular blockchain networks

- Encrypted Storage: Data encrypted locally and during transmission

- Firewall Protection: Built-in firewall blocks unauthorized wallet interactions

- Transaction Verification: Clear confirmations before every blockchain transaction

- Regulatory Alignment: Designed to align with evolving global compliance standards

Pros

- The interface feels intuitive, even for complete beginners.

- Security design reduces common mistakes I often see traders make.

- No seed phrases lowers anxiety for new crypto users.

- Customer support responds clearly according to TrustPilot reviews.

- Regular updates show commitment to long-term reliability.

Cons

- Advanced traders may find customization options limited.

- No direct desktop application limits some workflows.

- I find learning MPC concepts slightly confusing initially.

Visit: https://zengo.com/

2) Kraken

Expert Insights: Why Consider Kraken?

Kraken stands out when safety and credibility matter most. In uncertain crypto markets, a platform backed by strong principles helps beginners navigate risk perfectly while learning responsible trading habits.

Kraken is a long-established cryptocurrency exchange known for stability and trust. It launched early in the crypto industry and built credibility through consistent operations. The platform follows a security-first philosophy backed by rigorous internal controls. Its reputation is shaped by transparency, regulatory awareness, and disciplined risk management.

Kraken is widely respected among institutions and serious retail traders. It suits beginners who value safety over speculation. Long-term investors often prefer its conservative approach to custody. I have seen new traders gain confidence using Kraken’s steady environment. It is also backed by strong compliance standards across multiple regions. Overall, Kraken fits users seeking reliability rather than fast hype-driven gains.

Kraken Standout Features

- Cold Storage Custody: Majority of assets stored offline for reduced exposure

- Advanced Order Types: Supports conditional, margin, and futures trading options

- Fiat Onramps: Direct deposits and withdrawals through major global currencies

- Proof of Reserves: Publicly verifiable audits demonstrating full asset backing

- Regulatory Alignment: Operates within strict compliance across multiple jurisdictions

- API Access: Robust APIs for automated trading and portfolio integration

- Account Tiers: Flexible verification levels based on trading needs

- Margin Trading: Borrowed funds trading with defined risk parameters

- Staking Services: Earn protocol rewards directly from supported assets

- Platform Stability: High uptime during volatile market conditions

Pros

- The platform feels reliable during high volatility, from my experience.

- Security practices are consistently praised by Forbes and industry analysts.

- Customer funds are well protected through layered safeguards.

- I appreciate the transparency around audits and reserve disclosures.

- The interface supports deliberate trading rather than impulsive decisions.

Cons

- Verification can feel slow; I noticed delays during high demand.

- Limited token listings may frustrate aggressive altcoin traders.

Visit: https://www.kraken.com/

3) Coinbase

Expert Insights: Why Consider Coinbase?

Coinbase stands out within safest crypto exchanges because trust matters. For newcomers seeking confidence, transparency, and regulatory alignment, it offers a structured gateway. Its long-standing presence reassures cautious investors who prioritize protection, accountability, and a compliant environment before exploring broader crypto opportunities.

Coinbase is one of the most recognized names in cryptocurrency trading globally. Founded in the United States, it built its reputation by emphasizing regulatory compliance and institutional-grade safeguards. The platform follows a security-first philosophy, with risk controls backed by established financial standards and oversight. Over the years, Coinbase has earned credibility among regulators, enterprises, and retail users alike, supported by public reporting and strong governance practices.

I have seen many beginners gravitate toward Coinbase because the environment feels predictable and controlled. The exchange is backed by a publicly listed parent company, which adds transparency uncommon in crypto markets. Its brand reputation positions it as a conservative entry point rather than a speculative playground. Coinbase is best suited for beginners, long-term holders, and compliance-focused traders who value clarity, simplicity, and peace of mind over advanced trading complexity. For safety-first users, it fits perfectly within a risk-aware strategy.

Coinbase Standout Features

- Regulatory Compliance: Licensed operations aligned with United States financial regulations

- Cold Storage Custody: Majority of assets stored offline for enhanced protection

- Insurance Coverage: Digital assets insured against specific custodial security breaches

- Fiat Integration: Direct bank transfers supporting multiple local currencies globally

- User Interface: Clean dashboard designed for clarity and beginner usability

- Mobile Applications: Native iOS and Android apps with full account functionality

- Asset Selection: Supports major cryptocurrencies and vetted emerging digital assets

- Transaction Transparency: Clear trade confirmations with visible pricing breakdowns

- Account Recovery: Structured recovery process for lost credentials and access

- Institutional Services: Dedicated platform supporting professional and enterprise investors

Pros

- Coinbase offers intuitive onboarding that reduces beginner confusion significantly.

- Security practices align with regulated financial institutions, building strong trust.

- I value the transparency from public financial disclosures.

Cons

- Fees feel high compared to alternative global exchanges.

- Limited advanced trading tools restrict experienced strategy execution.

Visit: https://www.coinbase.com/

4) Binance

Expert Insights: Why Consider Binance?

Binance remains a leading option when safety-focused traders evaluate global crypto platforms. Its scale, long market presence, and steady user growth make it worth attention. Especially for beginners seeking stability in uncertain markets.

Binance is one of the most established cryptocurrency exchanges operating globally today. Launched in 2017, it quickly built credibility through consistent uptime and strong risk controls. The platform follows a security-first philosophy, emphasizing asset protection and operational resilience. Its reputation is backed by large trading volumes and widespread international adoption.

From my experience, Binance suits beginners who want structure and guidance. It also supports intermediate traders seeking depth without complexity. The exchange is backed by a broad ecosystem that reinforces trust and long-term viability. Regulatory efforts vary by region, yet transparency remains a priority. Overall, it aligns perfectly with users wanting a balance between safety and accessibility.

Binance Standout Features

- Account Security: Multi-layer protection using authentication, monitoring, and withdrawal safeguards

- Insurance Fund: Emergency asset fund designed to offset unexpected security incidents

- Liquidity Depth: High trading volumes reduce slippage during volatile market conditions

- Global Access: Available across numerous countries with multilingual interface support

- Fiat Gateways: Supports direct deposits and withdrawals using local currencies

- Mobile Platform: Fully functional trading experience through dedicated mobile applications

- Order Types: Advanced order options supporting strategic trade execution

- Compliance Tools: Built-in identity verification aligned with regional regulations

- Asset Variety: Supports hundreds of cryptocurrencies across major blockchain networks

- Educational Hub: Integrated learning resources explaining crypto concepts for beginners

Pros

- The platform feels stable even during heavy market volatility.

- I appreciate the consistent performance during high traffic trading periods.

- Wide asset selection supports diversified portfolio building.

- Security measures inspire confidence for long-term holdings.

- Fee structure remains competitive compared with major exchanges.

Cons

- Regulatory availability differs depending on user location.

- Advanced tools may confuse users with very basic knowledge.

Visit: https://www.binance.com/en

5) PrimeXBT

Expert Insights: Why Consider PrimeXBT?

PrimeXBT has become a popular choice among traders seeking a reliable platform for diversified crypto trading. Its growing reputation in both traditional and digital asset markets makes it a strong contender for users looking for flexibility, speed, and efficient market access under one roof.

PrimeXBT is a multi-asset trading platform that offers access to cryptocurrencies, forex, commodities, and indices from a single account. Established in 2018, it has steadily gained trust for its reliability and strong focus on user fund protection. The platform operates with a robust security framework, including cold storage and advanced encryption, to ensure user safety.

Its performance-driven infrastructure enables fast order execution, which is critical for professional traders and institutions. However, beginners also find its simplified dashboard and accessible design easy to navigate. I have personally found PrimeXBT’s learning curve smoother than other advanced exchanges, making it suitable for traders who value both simplicity and power. Overall, it is a globally recognized platform, backed by a proven record of uptime and regulatory compliance.

PrimeXBT Standout Features

- Multi-asset trading: Access crypto, forex, and commodities on one platform.

- Leverage options: Trade major pairs with flexible leverage up to 200x.

- Copy trading: Follow experienced traders and mirror their strategies easily.

- Customizable interface: Modify charts and layouts for personal trading style.

- Low latency execution: Lightning-fast order processing for real-time trading accuracy.

- Advanced charting tools: Integrated analytics powered by TradingView interface.

- Cold storage security: User funds stored offline for maximum protection.

- Non-custodial wallet: Retain control and ownership of your digital assets.

- Cross-margin system: Manage risk efficiently with unified margin management.

Pros:

- Trading fees are among the lowest in the industry.

- We found the copy-trading option highly effective for passive gains.

- I appreciate the fast withdrawals and transparent processing system.

- Security measures are top-notch and regularly audited for compliance.

Cons:

- I noticed limited fiat deposit options for some regions.

- We found margin trading riskier without proper experience.

Visit: https://primexbt.com/

6) ChangeNOW

Expert Insights: Why Consider ChangeNOW?

ChangeNOW is a trusted crypto exchange platform designed for seamless, instant transactions. It appeals to traders who value flexibility, transparency, and ease of use. For individuals exploring safer, non-custodial exchange options, ChangeNOW offers a perfectly balanced entry point into the crypto ecosystem.

ChangeNOW is a non-custodial cryptocurrency exchange that enables users to swap crypto assets instantly without requiring registration or storing user funds. Established in 2017, it has built a reputation for reliability and trust, backed by its transparent operations and strong security measures. The platform supports hundreds of digital currencies and integrates with major wallets and services to ensure smooth transfers.

Its security philosophy centers around decentralization—meaning users always maintain control of their assets. I appreciate how the process eliminates unnecessary intermediaries, reducing exposure to risks common in custodial exchanges. ChangeNOW is perfectly suited for beginners who value simplicity as well as experienced traders who prioritize speed and privacy in their crypto transactions.

ChangeNOW Standout Features

- Non-Custodial Model: Users retain full control over their funds always.

- Instant Swaps: Transactions execute within minutes without lengthy verification.

- Wide Coin Support: Over 900 cryptocurrencies available for exchange.

- Transparent Rates: Real-time floating and fixed rate options offered.

- Cross-Chain Compatibility: Allows direct swaps between different blockchains.

- API Integration: Enables businesses to embed instant crypto exchanges easily.

- KYC-Free Transactions: No mandatory registration for standard trades.

- High Transaction Limits: Large exchanges possible without complex verification.

- Wallet Partnerships: Integrated with popular crypto wallets for easy access.

- Auto Exchange Tracking: Real-time monitoring of transaction progress provided.

Pros:

- It provides smooth, fast transactions every time I trade.

- Users can exchange crypto without creating an account.

- Rates stay competitive across many popular cryptocurrencies.

- Customer support responds promptly to technical or account questions.

Cons:

- There is no native wallet for direct fund storage.

- I wish it had more advanced charting and analytics tools.

Visit: https://changenow.io/

7) Bybit

Expert Insights: Why Consider Bybit?

Bybit stands out as a comprehensive crypto exchange offering advanced trading tools with competitive fee structures. Traders seeking derivatives markets, spot trading, and copy trading features will find Bybit delivers institutional-grade infrastructure. Its commitment to liquidity and user protection makes it a compelling choice for active cryptocurrency participants.

Bybit is a global cryptocurrency exchange established in 2018. The platform serves millions of users across over 160 countries. It prioritizes robust security through cold wallet storage and multi-signature technology. Bybit maintains regulatory compliance in multiple jurisdictions. The exchange focuses on delivering professional-grade trading infrastructure.

The platform suits intermediate to advanced traders. It offers derivatives, spot markets, and NFT trading. Bybit provides 24/7 customer support in multiple languages. I have observed that Bybit consistently maintains high liquidity levels. This ensures smooth order execution even during volatile market conditions.

The exchange implements industry-standard security protocols. Regular security audits strengthen platform integrity. Bybit holds a strong reputation for transparency. The platform publishes proof-of-reserves reports regularly. This builds trust with the trading community. New users can access educational resources. The platform supports fiat-to-crypto onboarding in many regions.

Bybit Standout Features

- Derivatives Trading: Perpetual and futures contracts with up to 100x leverage available

- Copy Trading: Automatically replicate strategies from experienced traders in real-time

- Unified Trading Account: Manage spot, derivatives, and options from single account interface

- Trading Bots: Automated grid and DCA bots for hands-free strategy execution

- Launchpad Access: Early investment opportunities in vetted blockchain projects before public listing

- Dual Asset Earning: Generate yields from two cryptocurrencies simultaneously through structured products

- NFT Marketplace: Buy, sell, and trade non-fungible tokens with low transaction fees

- Institutional Services: Prime brokerage, OTC desk, and custody solutions for large traders

- VIP Program: Tiered benefits including reduced fees and dedicated account management

- P2P Trading: Direct peer-to-peer cryptocurrency purchases with multiple payment methods supported

- Proof of Reserves: Transparent on-chain verification of platform assets protecting user funds

Pros:

- Competitive maker-rebate fee structure reduces active trading costs significantly.

- Extensive derivative products cater to sophisticated hedging and speculation strategies.

- Deep liquidity pools ensure minimal slippage on large orders.

Cons:

- Limited fiat currency support restricts direct bank deposit options currently.

Visit: https://www.bybit.com/en/

8) OKX

Expert Insights: Why Consider OKX?

The OKX exchange has become a trusted name for secure crypto trading. It combines deep liquidity, institutional-grade infrastructure, and global accessibility for both new and experienced users. Many traders view OKX as a gateway to reliable and diversified digital asset exposure.

OKX is a globally recognized cryptocurrency exchange launched in 2017, known for its robust infrastructure and advanced trading ecosystem. Built with a strong emphasis on transparency and user protection, OKX has consistently ranked among the safest crypto exchanges in the world. The platform employs rigorous security protocols, including real-time monitoring, cold storage, and comprehensive risk management systems.

Its reliability has earned it widespread recognition from both institutional and retail traders. I have personally found OKX’s interface intuitive and stable, even during market volatility. The exchange’s global compliance standards and adaptive regulatory strategy further reinforce user confidence.

OKX is best suited for users who value security, transparency, and access to a wide range of digital assets. Whether you are a beginner learning to trade or an advanced user managing a diverse portfolio, OKX offers a dependable environment to engage with the crypto market responsibly.

OKX Standout Features

- Security: Multi-layer encryption and cold wallet storage protect digital assets.

- Transparency: Regular proof-of-reserves audits ensure verifiable asset backing.

- Global Access: Supports over 180 countries with multilingual interfaces.

- Liquidity: Deep order books ensure fast execution with minimal slippage.

- NFT Marketplace: Integrated platform for minting, trading, and collecting NFTs.

- Derivatives Trading: Wide range of futures and perpetual contracts available.

- DeFi Integration: Users can stake, lend, or earn yield directly on-platform.

Pros:

- Trading feels fast during normal market conditions.

- The interface is clean after a short learning curve.

- I find portfolio views helpful for quick daily checks.

- Fees feel reasonable for frequent, active trading habits.

Cons:

- I have seen strict checks delay withdrawals sometimes.

Visit: https://www.okx.com/

Comparison Table: Safest Crypto Exchanges

| Crypto Exchange | Zengo | Kraken | Coinbase | Binance |

| Best For | Beginners wanting maximum wallet security | Advanced users prioritizing security & transparency | Beginners & institutions needing regulatory trust | Active traders needing liquidity & features |

| Pricing | Free wallet, optional paid security plan | Trading fees (maker/taker model) | Higher retail trading fees | Low trading fees, discounts with BNB |

| Custodial / Non-custodial | Non-custodial | Custodial | Custodial | Custodial |

| Account Recovery Safety | MPC-based keyless recovery | Standard account recovery | Standard account recovery | Standard account recovery |

| Cold Storage Usage | ✅ | ✅ | ✅ | ✅ |

| Regulatory Compliance | Partial (wallet-based, no custody) | Strong (US & global licenses) | Strong (US-regulated public company) | Varies by region |

| History of Major Hacks | ❌ | ❌ | ❌ | ❌ |

| Two-Factor Authentication (2FA) | ✅ | ✅ | ✅ | ✅ |

| User Control Over Private Keys | ✅ | ❌ | ❌ | ❌ |

| Beginner-Friendly Interface | ✅ | Moderate | ✅ | Moderate |

| Mobile App Security Rating | High | High | High | High |

| KYC Required | ❌ | ✅ | ✅ | ✅ |

How Users Can Stay Safe Themselves

Staying safe on crypto exchanges is not only about choosing the right platform. Users also play a strong role in protecting their own funds. Even the safest crypto exchanges cannot fully protect accounts if basic habits are ignored. I have seen that small actions, done daily, reduce most common risks.

Good personal security builds a strong second layer of protection. My advice focuses on habits that work for beginners and experienced users alike. These steps stay relevant as threats keep changing.

- Use a strong and unique password for every exchange account. Avoid reusing email or banking passwords.

- Turn on two-factor authentication using an app instead of SMS when possible.

- Never share recovery phrases, private keys, or login codes with anyone.

- Check website URLs carefully before logging in to avoid fake copies.

- Use a dedicated email only for crypto-related accounts.

- Keep devices updated with the latest system and security patches.

- Avoid public Wi-Fi when trading or accessing wallets.

- Store large amounts in cold wallets instead of keeping everything on exchanges.

- Review account activity and login history regularly.

- Learn how phishing messages look and ignore urgent or emotional messages.

Common Security Risks to Watch Out For

Crypto exchanges face many risks, even the safest ones. I have seen that knowing these risks helps users make smarter choices. Clear awareness also supports better daily habits that reduce loss and stress.

- Phishing attacks try to trick users with fake emails or links that copy real exchange pages.

- Weak passwords remain a common issue and make accounts easy targets for automated attacks.

- Poor two factor setup can allow hackers to bypass basic login protection steps.

- Fake mobile apps or browser extensions can steal login data without clear warning signs.

- Hot wallet exposure increases risk because online funds stay connected to the internet.

- API key leaks can lead to silent trading or withdrawals if permissions are too open.

- Social engineering uses trust and urgency to push users into sharing private details.

- Outdated platform security may miss new threat patterns and delay important fixes.

Even when using Safest Crypto Exchanges, extra care matters. Use hardware wallets for long-term storage. Enable every security feature offered. Withdraw long-term holdings instead of leaving them online. Avoid over-exposure to one platform to reduce risk if a breach or outage happens.

FAQs

Are crypto exchanges insured?

Some crypto exchanges offer limited insurance, usually covering losses from internal breaches—not user errors or market losses. For example, custodial insurance may protect hot-wallet funds only. Insurance rarely covers all assets. Always review policy scope, exclusions, and whether coverage applies per user or per incident.

Can exchanges freeze funds?

Yes, centralized exchanges (CEXs) can freeze funds due to legal orders, compliance checks, suspicious activity, or policy violations. They control private keys, giving them authority to restrict withdrawals. Decentralized exchanges (DEXs) generally cannot freeze funds because users retain custody, unless smart contracts include pause or admin controls.

What happens if an exchange is hacked?

If hacked, outcomes depend on the exchange’s security and reserves. Some reimburse users using insurance or recovery funds; others may halt withdrawals or suffer losses. Investigations usually follow. Users may experience delays or partial recovery. Using exchanges with proof-of-reserves and strong security history reduces risk.

Are DEXs safer than CEXs?

DEXs reduce custodial risk because users control their private keys. However, they introduce smart contract, phishing, and user-error risks. CEXs offer convenience and support but are hack and freeze-prone. Safety depends on user skill: DEXs suit experienced users, while reputable CEXs are safer for beginners.

What is the safest crypto exchange overall?

No exchange is 100% safe, but top-tier platforms like Zengo, Kraken, and Coinbase are widely considered among the safest due to regulation, audits, proof-of-reserves, and strong security practices. Safety depends on transparency, jurisdiction, cold storage use, and long operational history—not popularity alone.

Are US-based exchanges safer than international ones?

US-based exchanges are generally safer due to stricter regulations, compliance requirements, and consumer protections. They must follow AML, KYC, and reporting rules. However, regulation doesn’t eliminate risk. Some international exchanges are equally secure, but users should verify licensing, audits, and legal accountability.

How can I verify an exchange’s security claims?

Verify security claims by checking third-party audits, proof-of-reserves reports, bug bounty programs, and transparency pages. Review regulatory licenses, insurance disclosures, and breach history. Cross-check claims with independent sources, security researchers, and user reports. Avoid exchanges that lack verifiable documentation or clear custody practices.

What should I do if an exchange gets hacked?

Immediately secure your account: change passwords, enable 2FA, and revoke API keys. Monitor official updates and follow withdrawal guidance. Document balances and transactions. Contact support promptly. Avoid phishing links. If funds are lost, track announcements on recovery or reimbursement plans and report incidents if required.

Is it safer to use a decentralized exchange (DEX)?

A DEX can be safer for custody since you control your assets, reducing counterparty risk. However, safety depends on smart contract quality, wallet security, and user knowledge. Risks include exploits, fake tokens, and irreversible transactions. DEXs are safer only when used carefully and correctly.

Final Verdict: Choosing the Safest Exchange for You

There is no 100% safe exchange, only lower-risk options that manage threats better. I always suggest choosing platforms with strong security layers, clear compliance, and a solid track record. Your needs also matter, such as trading style and storage habits. The safest choice is the one you actively protect with smart settings and disciplined use.